Dive into the world of tax planning tips, where savvy individuals and businesses strategically navigate the complex tax landscape to save big bucks and secure their financial future. From income deferral to tax-efficient investments, we’ll explore the key strategies that can lead to substantial savings and long-term wealth preservation.

Get ready to uncover the secrets of tax planning and discover how you can optimize your financial management for a brighter tomorrow.

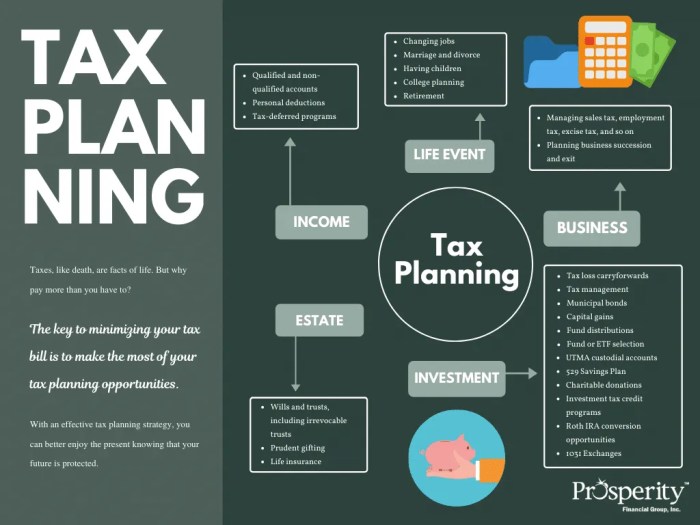

Importance of Tax Planning

Tax planning is essential for both individuals and businesses to optimize their financial situation by minimizing the amount of taxes owed while remaining compliant with the law. Effective tax planning can lead to significant savings by taking advantage of deductions, credits, and other tax incentives that may be available.

Maximizing Deductions and Credits

One of the key benefits of tax planning is the ability to maximize deductions and credits. By carefully strategizing and structuring financial transactions, individuals and businesses can reduce their taxable income, resulting in lower tax liabilities. For example, individuals can deduct expenses related to education, healthcare, and charitable contributions, while businesses can take advantage of credits for research and development or investments in renewable energy.

Long-Term Wealth Preservation

Tax planning also plays a crucial role in long-term wealth preservation. By implementing strategies such as estate planning, retirement account contributions, and investment planning, individuals can protect and grow their assets over time. Proper tax planning ensures that assets are transferred efficiently to future generations while minimizing estate taxes and other potential tax burdens.

Financial Management Benefits

Furthermore, tax planning is an integral part of overall financial management. By incorporating tax considerations into financial decision-making processes, individuals and businesses can make informed choices that align with their long-term goals. Whether it’s deciding on investment options, business structures, or retirement planning, tax planning provides a framework for achieving financial success while minimizing tax implications.

Tax Planning Strategies

When it comes to tax planning, there are several strategies that individuals and businesses can utilize to minimize their tax liability and maximize their savings. These strategies include income deferral, deductions optimization, and investing in tax-efficient accounts.

Income Deferral

Income deferral is a strategy where individuals or businesses postpone receiving income to a future year in order to reduce their current tax burden. By delaying income, taxpayers can potentially lower their tax rate and defer paying taxes on that income until a later date when they may be in a lower tax bracket.

Deductions Optimization

Deductions optimization involves maximizing the use of tax deductions to reduce taxable income. This can be achieved by taking advantage of deductions such as charitable contributions, mortgage interest, and business expenses. By optimizing deductions, taxpayers can lower their taxable income and ultimately decrease the amount of taxes owed.

Tax-Efficient Investments

Investing in tax-efficient accounts such as 401(k) plans, IRAs, and Health Savings Accounts (HSAs) can also be a valuable tax planning strategy. These accounts offer tax advantages such as tax-deferred growth, tax deductions on contributions, or tax-free withdrawals for qualified expenses. By strategically allocating investments in these accounts, taxpayers can minimize their tax liability and increase their savings.

Short-term vs. Long-term Tax Planning Strategies

While short-term tax planning strategies focus on immediate tax savings, long-term tax planning strategies involve planning for future tax implications and financial goals. Short-term strategies may include taking advantage of tax deductions and credits for the current year, while long-term strategies may involve estate planning, retirement savings, and investment planning to minimize taxes over a longer period.

Benefits of Tax Planning Tools

Tax planning tools such as tax-advantaged accounts and tax credits offer various benefits to taxpayers. Tax-advantaged accounts provide opportunities for tax-deferred growth and tax deductions, while tax credits directly reduce tax liability. By utilizing these tools effectively, individuals and businesses can optimize their tax planning strategies and maximize their savings.

Tax-Efficient Investment Tips

Investing tax-efficiently is crucial to minimize tax liabilities and maximize returns on investments. Strategic planning can help mitigate the impact of capital gains tax, allowing you to keep more of your hard-earned money. Here are some tips to help you invest in a tax-efficient manner:

Utilize Tax-Advantaged Accounts

One way to invest tax-efficiently is to take advantage of tax-advantaged accounts such as IRAs, 401(k)s, and 529 plans. These accounts offer tax benefits that can help reduce your tax burden and allow your investments to grow tax-free or tax-deferred.

Consider Index Funds and ETFs

Investing in index funds and exchange-traded funds (ETFs) can be a tax-efficient strategy because they typically have lower turnover rates compared to actively managed funds. This means fewer capital gains distributions, resulting in lower tax liabilities for investors.

Harvest Tax Losses

Tax-loss harvesting involves selling investments that have experienced a loss to offset capital gains and reduce taxable income. By strategically selling losing investments, you can minimize taxes while rebalancing your portfolio.

Diversify Your Portfolio

Diversification is key to reducing risk in your investment portfolio, but it can also have tax benefits. By spreading your investments across different asset classes, you can potentially offset gains in one area with losses in another, reducing your overall tax liability.

Hold Investments Long-Term

Long-term investments are taxed at lower capital gains rates compared to short-term investments. By holding onto your investments for more than a year, you can benefit from lower tax rates and increase your after-tax returns.

Retirement Planning and Taxes

When it comes to retirement planning, understanding the tax implications of different accounts can make a significant impact on your savings. Proper tax planning can help you optimize your retirement savings and withdrawals, ensuring that you keep more of your hard-earned money in your pocket during your golden years.

Tax Implications of Different Retirement Accounts

- 401(k): Contributions to a traditional 401(k) are made with pre-tax dollars, reducing your taxable income in the present. However, withdrawals in retirement are taxed at your ordinary income tax rate.

- IRA: Similar to a 401(k), contributions to a traditional IRA are tax-deductible, but withdrawals are taxed as ordinary income. Roth IRAs, on the other hand, are funded with after-tax dollars, allowing for tax-free withdrawals in retirement.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, meaning withdrawals in retirement are tax-free. This can be advantageous if you expect to be in a higher tax bracket during retirement.

Optimizing Retirement Savings through Tax Planning

- Maximize contributions to tax-advantaged retirement accounts to take advantage of tax deductions and deferral on investment gains.

- Consider the timing of withdrawals to minimize taxes, especially if you have a mix of pre-tax and after-tax retirement accounts.

- Utilize strategies like Roth conversions to strategically shift funds from pre-tax accounts to Roth accounts, potentially reducing future tax liabilities.

Minimizing Taxes in Retirement through Proper Planning

- Plan your withdrawals to manage your tax bracket effectively, potentially avoiding higher tax rates on your retirement income.

- Explore options for tax-efficient investment strategies to generate income in retirement while minimizing taxable gains.

- Consider the impact of Social Security benefits on your taxable income and adjust your withdrawal strategy accordingly to optimize your tax situation.