Get ready to dive into the world of retirement savings plans! From the importance of starting early to maximizing your contributions, this guide has all you need to secure your financial future. So, grab a seat and let’s talk about how you can level up your retirement game.

When it comes to preparing for retirement, having a solid savings plan in place is key. Let’s explore the ins and outs of retirement savings plans to help you make the most of your golden years.

Importance of Retirement Savings Plans

Having a retirement savings plan is crucial for ensuring financial security in the future. It allows individuals to save and invest a portion of their income during their working years, so they can maintain their lifestyle and cover expenses during retirement.

Starting Early

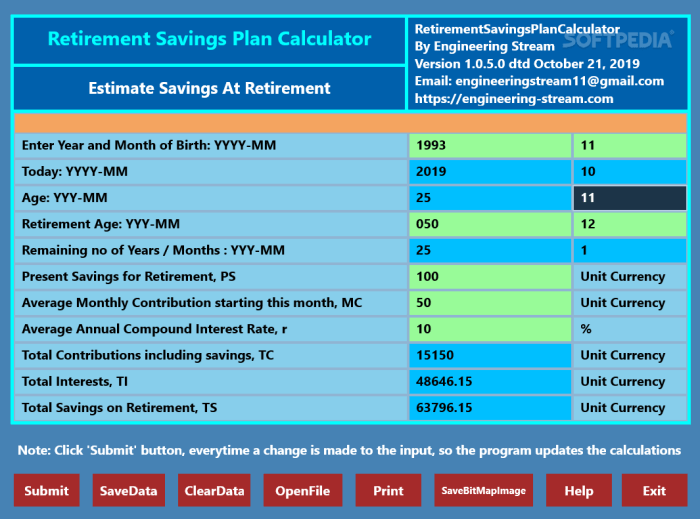

Starting a retirement savings plan early in one’s career has numerous benefits. By beginning to save at a young age, individuals can take advantage of compound interest and have more time for their investments to grow. This can significantly increase the amount of money available for retirement, making it easier to achieve financial independence later in life.

Maintaining Lifestyle

Retirement savings plans help individuals maintain their lifestyle after retirement by providing a source of income when they are no longer working. Whether through employer-sponsored plans like 401(k)s or individual retirement accounts (IRAs), these savings can supplement Social Security benefits and cover expenses such as housing, healthcare, and leisure activities. By planning and saving for retirement early, individuals can enjoy their golden years without financial stress.

Types of Retirement Savings Plans

When it comes to saving for retirement, there are several types of retirement savings plans to consider. Each type has its own features, eligibility criteria, and contribution limits. Let’s take a closer look at some of the most common options available:

401(k) Plan

A 401(k) plan is a retirement savings account that is sponsored by an employer. Employees can contribute a portion of their pre-tax income to the plan, and some employers may also match a percentage of these contributions. One key feature of a 401(k) plan is that contributions are tax-deferred until withdrawal, making it a popular choice for many workers.

Individual Retirement Account (IRA)

An IRA is a retirement savings account that is set up by an individual, rather than through an employer. There are different types of IRAs, including traditional IRAs and Roth IRAs. With a traditional IRA, contributions may be tax-deductible, but withdrawals are taxed as income. On the other hand, Roth IRAs offer tax-free withdrawals in retirement, but contributions are made with after-tax dollars.

Pension Plans

Pension plans are retirement benefits provided by some employers, where the employer contributes funds on behalf of the employee. Pension plans can vary in structure and may provide a set monthly payment to the retiree after reaching a certain age or years of service. While less common today, pension plans can offer a stable and guaranteed source of retirement income for some individuals.

Comparison of Features and Contribution Limits

- 401(k): Contributions are made through payroll deductions, with higher annual contribution limits compared to IRAs. Employers may match contributions.

- IRA: Can be set up by individuals, with different tax advantages based on the type of IRA chosen. Contribution limits are lower than 401(k) plans.

- Pension Plans: Offer a guaranteed benefit in retirement, with contributions made by the employer. Benefits are typically based on years of service and salary.

Strategies for Maximizing Retirement Savings

Saving for retirement is crucial, and there are several strategies individuals can utilize to maximize their retirement savings. From taking advantage of employer matching contributions to implementing smart investment strategies, here are some tips to boost your retirement nest egg.

Employer Matching Contributions

Employer matching contributions are like free money for your retirement savings. Many employers offer to match a certain percentage of an employee’s contributions to their retirement plan, up to a specified limit. For example, if your employer matches 50% of your contributions up to 6% of your salary, make sure you contribute at least 6% to take full advantage of the match. This can significantly boost your retirement savings over time.

Investment Strategies

When it comes to investing within your retirement savings plan, consider diversifying your portfolio to manage risk and potentially increase returns. Allocate your contributions across different asset classes such as stocks, bonds, and mutual funds based on your risk tolerance and time horizon. Rebalance your portfolio periodically to ensure it aligns with your retirement goals and adjust your investment strategy as needed.

- Consider investing in low-cost index funds or exchange-traded funds (ETFs) to minimize fees and maximize returns over the long term.

- Take advantage of compounding interest by reinvesting dividends and capital gains to accelerate the growth of your retirement savings.

- Review your investment options regularly and seek professional advice if needed to optimize your retirement portfolio.

Risks and Challenges Associated with Retirement Savings Plans

Saving for retirement comes with its own set of risks and challenges that individuals need to be aware of in order to secure their financial future. Let’s dive into some common risks and challenges associated with retirement savings plans and how to navigate through them.

Market Volatility and Inflation

Market volatility and inflation are two major risks that can significantly impact retirement savings plans. Market fluctuations can lead to a decrease in the value of investments, affecting the overall growth of retirement funds. On the other hand, inflation erodes the purchasing power of money over time, making it essential to ensure that retirement savings keep up with rising costs.

To mitigate these risks, individuals can consider diversifying their investment portfolio to spread out risks across different asset classes. By investing in a mix of stocks, bonds, and other financial instruments, individuals can minimize the impact of market volatility. Additionally, adjusting the investment strategy to include inflation-protected securities can help combat the effects of inflation on retirement savings.

Personal Circumstances and Adaptation

Changes in personal circumstances such as job loss, health issues, or unexpected expenses can pose challenges to retirement savings plans. It’s crucial to have a contingency plan in place to address these unexpected events and ensure that retirement goals remain on track.

One strategy to adapt to changing circumstances is to regularly review and adjust the retirement savings plan as needed. By reassessing financial goals, risk tolerance, and investment strategies, individuals can better prepare for unforeseen challenges and make necessary adjustments to secure their financial future.