Yo, listen up! Income tax on investments is about to drop some serious knowledge on you. Get ready to dive into the world of investment taxes like a boss, with examples and calculations that will blow your mind.

Now, let’s break it down for you in the next paragraph with all the deets you need to know.

Overview of Income Tax on Investments

Investors, listen up! Income tax on investments is the money you owe the government on the profits you make from your investments. It’s like giving Uncle Sam a piece of the pie when your investments pay off big time.

Different types of investments can be subject to income tax, such as:

- Stocks: When you sell stocks for a profit, that money is subject to income tax.

- Bonds: Interest earned from bonds is also taxable.

- Real Estate: Rental income and capital gains from selling property are included in your taxable income.

Now, let’s talk about how income tax on investments is calculated. It’s not as simple as 1+1=2, but here’s the gist of it:

Income tax on investments is typically calculated based on the type of investment, how long you held it, and your overall income tax bracket.

Remember, it’s essential to stay on top of your investment taxes to avoid any surprises come tax season. Stay informed, stay smart, and keep that money flowing!

Types of Investment Income

When it comes to investment income, there are different types that you need to know about. Let’s break it down for you!

Interest Income

Interest income is money you earn from investments like bonds, CDs, or savings accounts. This type of income is typically taxed at your ordinary income tax rate. For example, if you earn $500 in interest from a bank account, that $500 will be added to your total income for the year and taxed accordingly.

Dividend Income

Dividend income is what you receive from owning stocks in a company. This income can be classified as qualified or non-qualified, which determines the tax rate. Qualified dividends are taxed at a lower rate than non-qualified dividends. For instance, if you receive $1,000 in qualified dividends, you may pay a lower tax rate compared to the tax rate on non-qualified dividends.

Capital Gains

Capital gains are profits made from selling investments like stocks, real estate, or mutual funds. These gains can be classified as short-term or long-term, depending on how long you held the investment. Short-term capital gains are taxed at your ordinary income tax rate, while long-term capital gains have a lower tax rate. For example, if you sell a stock for a profit after holding it for more than a year, you may qualify for the lower long-term capital gains tax rate.

Taxation of Capital Gains

When it comes to investing, capital gains play a crucial role in determining the profitability of an investment. Capital gains are the profits earned from the sale of an investment asset, such as stocks, bonds, or real estate, that have increased in value since the time of purchase. These gains are a key component of an investor’s overall return on investment.

Capital Gains Taxation

Capital gains are taxed differently from other forms of investment income, such as dividends or interest. While dividends and interest income are typically taxed at ordinary income tax rates, capital gains are subject to special capital gains tax rates. These rates are generally lower than ordinary income tax rates, providing an incentive for long-term investment.

- Short-Term Capital Gains: Short-term capital gains are profits earned from the sale of an asset held for one year or less. These gains are taxed at ordinary income tax rates, which can be significantly higher than long-term capital gains tax rates.

- Long-Term Capital Gains: Long-term capital gains are profits earned from the sale of an asset held for more than one year. These gains are taxed at preferential capital gains tax rates, which are typically lower than ordinary income tax rates. The exact rate depends on the investor’s income level and filing status.

It’s important to note that the holding period of an investment can have a significant impact on the amount of taxes owed on capital gains.

Capital Gains Tax Rates

The capital gains tax rates vary based on the holding period of the investment. Generally, the longer an investor holds an asset before selling it, the lower the tax rate on any resulting capital gains. The tax rates for long-term capital gains are typically more favorable compared to short-term capital gains, providing an incentive for investors to hold onto their assets for the long term.

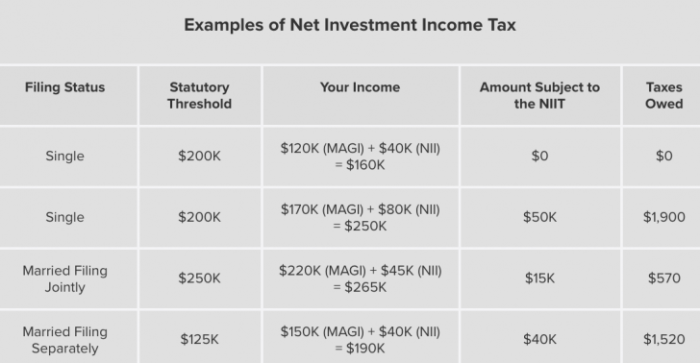

- For 2021, the capital gains tax rates range from 0% to 20%, depending on the investor’s income level and filing status. Higher-income individuals may also be subject to an additional 3.8% Net Investment Income Tax on capital gains.

- It’s essential for investors to understand the capital gains tax rates applicable to their specific situation to effectively plan their investment strategies and minimize tax liabilities.

Tax-Advantaged Investment Accounts

Investing in tax-advantaged accounts is a smart way to grow your money while minimizing your tax liability. These accounts offer special tax benefits that can help you save more for the future.

401(k) Retirement Account

The 401(k) retirement account is a popular tax-advantaged investment account offered by many employers. Employees can contribute a portion of their pre-tax income to this account, reducing their taxable income for the year. The contributions grow tax-deferred until withdrawal during retirement, at which point they are taxed as ordinary income.

Individual Retirement Account (IRA)

An Individual Retirement Account (IRA) is another tax-advantaged investment account available to individuals. There are different types of IRAs, including Traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement. Contribution limits and tax benefits vary depending on the type of IRA.

Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-advantaged account that allows individuals with high-deductible health insurance plans to save for medical expenses. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. HSA funds can also be invested, allowing for potential growth over time.