When it comes to home equity loans vs lines of credit, buckle up for a ride through the world of financial decisions. Get ready to dive into the nitty-gritty details that can impact your wallet and future plans.

Let’s break down the key differences between these two options and help you navigate the maze of terms, conditions, risks, and rewards.

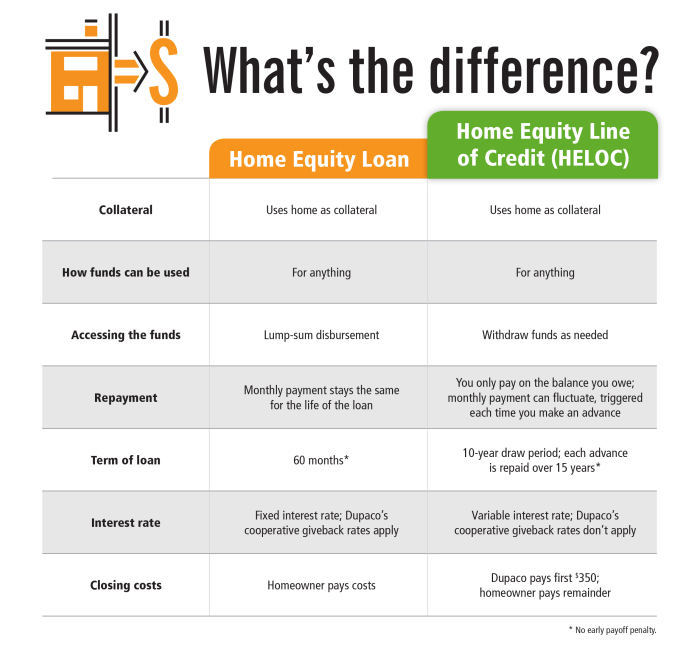

Comparison of Home Equity Loans and Lines of Credit

When it comes to borrowing against your home’s equity, you have options like home equity loans and lines of credit. Let’s break down the key differences and help you figure out which one might work best for you.

Differences Between Home Equity Loans and Lines of Credit

- Home Equity Loan: This type of loan provides you with a lump sum of money upfront, which you repay over time with a fixed interest rate. It’s ideal for one-time expenses like a home renovation project.

- Line of Credit: A line of credit, on the other hand, acts more like a credit card where you have a set credit limit and can borrow as needed. You only pay interest on the amount you use, and the interest rate is typically variable.

Examples of Situations Where One Might Be More Beneficial

- Home Equity Loan: If you have a specific expense in mind with a fixed cost, like paying for a child’s college tuition or consolidating high-interest debt, a home equity loan might be the better choice.

- Line of Credit: For ongoing expenses or projects with fluctuating costs, such as home improvements or medical bills, a line of credit offers more flexibility as you can borrow as needed without taking out a lump sum.

Pros and Cons of Each Option

- Home Equity Loan:

- Pros: Fixed interest rates, predictable monthly payments, ideal for one-time expenses.

- Cons: Requires discipline to avoid overspending, may have upfront fees or closing costs.

- Line of Credit:

- Pros: Flexibility to borrow as needed, pay interest only on what you use, revolving credit line.

- Cons: Variable interest rates, potential for overspending and accruing more debt.

Understanding Home Equity Loans

When it comes to home equity loans, it’s essential to know what you’re getting into. Let’s break it down for you.

A home equity loan is a type of loan where you borrow against the equity in your home. Equity is the difference between the current value of your home and the amount you still owe on your mortgage. This type of loan allows you to access a lump sum of money upfront, which you can repay over a set period of time, usually with a fixed interest rate.

Typical Terms and Conditions

- Loan Amount: Typically, you can borrow up to 85% of your home’s equity.

- Repayment Period: Home equity loans often have terms ranging from 5 to 30 years.

- Interest Rate: The interest rate for home equity loans is usually fixed, meaning it remains the same throughout the loan term.

- Collateral: Your home serves as collateral for the loan, which means the lender can foreclose on your property if you fail to repay the loan.

Potential Risks

-

Foreclosure Risk:

Since your home is used as collateral, failure to repay the loan could result in the loss of your home.

-

Interest Costs:

If interest rates rise, you could end up paying more over time, especially with a long repayment period.

-

Resetting of Rates:

Some home equity loans have variable interest rates that can reset, leading to higher monthly payments.

Exploring Lines of Credit

When it comes to home equity, a line of credit can be a game-changer. Let’s dive into the details of what a home equity line of credit (HELOC) is all about.

Understanding HELOC

A HELOC is a type of loan that allows homeowners to borrow against the equity in their home. It functions similarly to a credit card, where you have a predetermined credit limit and can borrow up to that limit as needed.

Differences from Home Equity Loans

Unlike a traditional home equity loan, which provides a lump sum upfront, a HELOC gives you the flexibility to borrow funds as needed over a specified period. You only pay interest on the amount you borrow, not the entire credit line.

Flexibility and Risks

One of the key advantages of a HELOC is its flexibility. You can use the funds for various purposes, such as home renovations, debt consolidation, or emergencies. However, this flexibility also comes with risks, as variable interest rates can increase your monthly payments unexpectedly.

Factors to Consider Before Choosing

When deciding between a home equity loan and a line of credit, there are several key factors to consider to make the best choice for your financial needs.

Interest Rates

Interest rates play a crucial role in determining which option is more suitable for you. Home equity loans typically have fixed interest rates, providing stability in monthly payments. On the other hand, lines of credit usually have variable interest rates, which can lead to fluctuations in payment amounts. Consider your comfort level with potential rate changes and how they may impact your budget.

Loan Amount and Usage

Think about the amount of money you need and how you plan to use it. Home equity loans are better for large, one-time expenses like home renovations, while lines of credit are more flexible for ongoing or unpredictable expenses. Assess your financial goals and determine the best fit based on your borrowing needs.

Repayment Terms

Evaluate the repayment terms of each option. Home equity loans typically have fixed monthly payments over a set period, making it easier to budget. Lines of credit, on the other hand, offer more flexibility in repayment but may come with higher minimum payments or interest-only payment options. Consider your financial discipline and ability to manage payments effectively.

Risk Tolerance

Consider your risk tolerance when choosing between a home equity loan and a line of credit. Home equity loans use your home as collateral, so failing to repay could result in foreclosure. Lines of credit also pose risks if not managed properly, potentially leading to increased debt. Assess your comfort level with risk and choose the option that aligns with your financial goals.

Financial Goals

Ultimately, consider your long-term financial goals when deciding between a home equity loan and a line of credit. Determine how each option fits into your overall financial plan and choose the one that helps you achieve your objectives efficiently.