Dive into the world of financial stress management where the hustle and bustle of everyday life meets the need for balance and control. This guide is your ticket to understanding the ins and outs of managing financial stress with a touch of American high school hip style. Get ready for a journey filled with tips, tricks, and insights that will empower you to take charge of your financial well-being.

As we navigate through the different aspects of financial stress management, you’ll uncover strategies, seek professional advice, and explore lifestyle changes that can lead to a healthier relationship with your finances.

Understanding Financial Stress

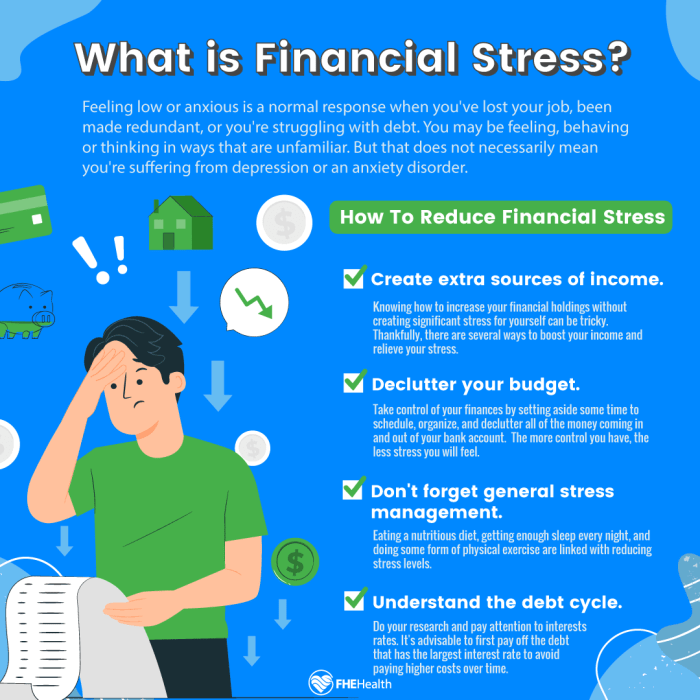

Financial stress is the anxiety and worry caused by financial problems or challenges, which can have a significant impact on mental health. It can manifest in various ways, such as feeling overwhelmed, having trouble sleeping, or experiencing physical symptoms like headaches or stomach issues. Financial stress can also lead to feelings of hopelessness, depression, and low self-esteem.

Common Causes of Financial Stress

- High levels of debt, including credit card debt and student loans

- Lack of emergency savings

- Unemployment or underemployment

- Medical expenses

- Unexpected expenses like car repairs or home maintenance

Impact of Financial Stress on Relationships

Financial stress can put a strain on relationships, leading to arguments, resentment, and lack of trust. It can also create feelings of inadequacy or failure, causing individuals to withdraw or isolate themselves from their loved ones. Communication breakdowns and differences in financial priorities can further exacerbate the situation.

Signs of Financial Stress

- Constantly worrying about money

- Avoiding conversations about finances

- Difficulty making decisions due to financial concerns

- Changes in eating or sleeping patterns

- Increased irritability or mood swings

Strategies for Managing Financial Stress

Managing financial stress is crucial for maintaining mental well-being and achieving financial stability. By implementing effective strategies, individuals can alleviate the burden of financial worries and work towards a more secure future.

Importance of Budgeting

Budgeting plays a key role in reducing financial stress by helping individuals track their expenses, prioritize spending, and identify areas where they can cut back. By creating a budget and sticking to it, individuals can gain better control over their finances and reduce anxiety about money matters.

Setting Financial Goals

Setting clear and achievable financial goals is essential for alleviating stress. Whether it’s saving for a big purchase, paying off debt, or building an emergency fund, having specific goals in place can provide a sense of direction and motivation. By breaking down goals into smaller milestones, individuals can track their progress and stay focused on their financial objectives.

Creating an Emergency Fund

Establishing an emergency fund is a vital step in managing financial stress. By setting aside a portion of income in a separate savings account, individuals can create a financial buffer for unexpected expenses or income disruptions. Aim to save at least three to six months’ worth of living expenses to safeguard against financial emergencies and reduce the anxiety associated with financial instability.

Effective Communication About Financial Matters

Open and honest communication about financial matters is crucial for reducing stress in relationships. Whether it’s discussing budgeting strategies, financial goals, or spending habits, clear communication can help partners align their priorities and work together towards common objectives. Regularly checking in on financial progress and addressing concerns openly can strengthen trust and minimize conflicts related to money issues.

Seeking Professional Help

When facing overwhelming financial stress, seeking help from a financial advisor or counselor can be crucial in regaining control of your finances and mental well-being.

Benefits of Financial Therapy

- Financial therapy can help individuals understand the emotional and psychological factors influencing their financial decisions.

- This form of therapy can assist in breaking negative money patterns and promoting healthier financial behaviors.

- Therapists can provide personalized strategies to tackle financial stress and improve overall financial wellness.

Financial Planner vs. Therapist

- A financial planner focuses on creating financial plans, setting goals, and managing investments to achieve financial stability.

- On the other hand, a therapist addresses the emotional aspects of financial stress, helping individuals develop a healthier relationship with money.

- While a financial planner deals with the practical side of finances, a therapist delves into the underlying psychological issues contributing to financial stress.

Support Resources

- The Financial Therapy Association offers a directory of certified financial therapists who specialize in addressing financial stress.

- Non-profit organizations like the National Foundation for Credit Counseling provide counseling services to individuals struggling with debt and financial hardships.

- Local community centers and mental health clinics may offer free or low-cost financial counseling services for those in need.

Lifestyle Changes for Financial Well-being

In managing financial stress, lifestyle choices play a significant role in improving overall well-being. By adopting healthy financial habits and practicing self-care, individuals can reduce stress and achieve better financial management.

Benefits of Adopting a Minimalist Lifestyle

- A minimalist lifestyle focuses on living with less, which can lead to reduced expenses and increased savings.

- By decluttering and simplifying possessions, individuals can appreciate what they have and avoid unnecessary spending.

- Minimalism promotes mindfulness and intentionality in spending, helping to prioritize needs over wants.

Examples of Healthy Financial Habits

- Creating a budget and tracking expenses to ensure financial goals are met.

- Avoiding impulse purchases and researching before making big financial decisions.

- Setting up an emergency fund for unexpected expenses to avoid financial strain.

Self-care Practices for Better Financial Management

- Practicing mindfulness and stress-reducing activities like meditation or yoga can help individuals make better financial decisions.

- Regular exercise and a healthy diet contribute to overall well-being, reducing the likelihood of stress-induced spending.

- Seeking support from friends, family, or a financial advisor can provide guidance and accountability in managing finances effectively.