Get ready to dive into the world of credit score ranges explained. From understanding the basics to breaking down the nitty-gritty details, this guide has got you covered. So, buckle up and let’s explore the ins and outs of credit scores!

Let’s start by unraveling the mysteries behind credit score ranges and how they play a crucial role in your financial journey.

Understanding Credit Score Ranges

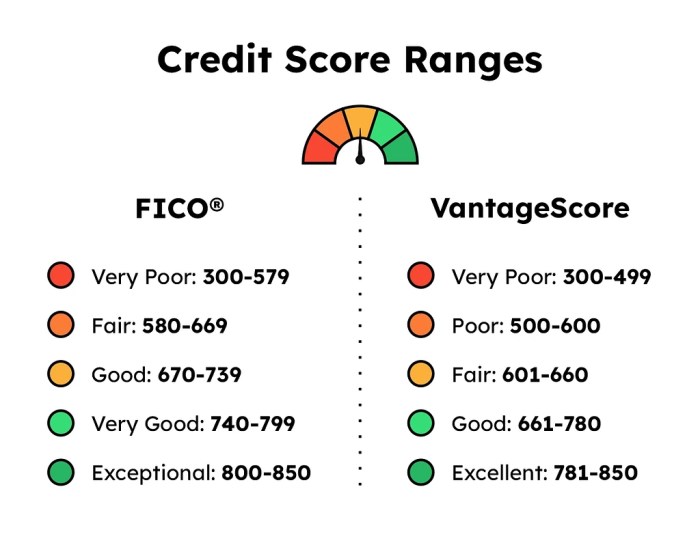

Credit score ranges are numerical values that represent an individual’s creditworthiness. They reflect a person’s credit history and help lenders assess the risk of providing credit to that individual. Common credit score ranges typically fall between 300 and 850, with higher scores indicating better creditworthiness.

Overview of Common Credit Score Ranges

- Credit scores below 580 are considered poor.

- A score between 580 and 669 is fair.

- Good credit scores range from 670 to 739.

- Very good scores fall between 740 and 799.

- Excellent credit scores are 800 and above.

Categorization of Credit Scores based on Ranges

- Credit scores are categorized into ranges to simplify the assessment of creditworthiness.

- Lenders use these ranges to determine the interest rates, loan terms, and credit limits offered to individuals.

- Higher credit scores typically result in better loan terms and lower interest rates.

Comparison of Credit Score Range Classifications

- Various credit bureaus may have slightly different ranges for categorizing credit scores.

- However, the general classification of poor, fair, good, very good, and excellent remains consistent across different bureaus.

- It is essential for individuals to understand the specific range used by the lender they are dealing with to gauge their creditworthiness accurately.

Factors Influencing Credit Scores

When it comes to determining credit scores, there are several key factors that play a significant role in shaping an individual’s creditworthiness. These factors can have a major impact on whether someone is approved for credit or not, as well as the interest rates they may receive.

Payment History

Your payment history is one of the most crucial factors that influence your credit score. It accounts for about 35% of your overall score and reflects how reliably you have paid your bills on time. Late payments, defaults, or bankruptcies can significantly lower your credit score, while a history of on-time payments can help improve it.

Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount of credit available to you. This ratio plays a vital role in determining your credit score, with lower utilization rates generally being more favorable. Keeping your credit utilization below 30% is typically recommended to maintain a healthy credit score.

Credit Inquiries and New Credit

When you apply for new credit, a hard inquiry is placed on your credit report, which can temporarily lower your score. Multiple credit inquiries within a short period may signal to lenders that you are seeking credit urgently, which can be viewed as a red flag. Additionally, opening several new credit accounts in a short period can also negatively impact your credit score.

Credit Score Range Breakdown

In this section, we will break down the typical credit score ranges and discuss their significance for lenders.

Poor Credit Score Range

A poor credit score typically falls below 580. Individuals in this range may have a history of missing payments, defaulting on loans, or having high levels of debt. Lenders may view these borrowers as high-risk and may be hesitant to approve loans or may offer them at higher interest rates.

Fair Credit Score Range

A fair credit score usually ranges from 580 to 669. Borrowers in this range may have a mix of positive and negative credit history. Lenders may still consider these individuals as moderate risk and may offer loans with slightly higher interest rates compared to those with good or excellent credit scores.

Good Credit Score Range

A good credit score typically falls between 670 and 739. Individuals in this range have a solid credit history with responsible borrowing habits. Lenders view these borrowers as lower risk and may offer them loans at competitive interest rates.

Excellent Credit Score Range

An excellent credit score is usually 740 and above. Borrowers in this range have an exceptional credit history, showing a track record of timely payments and low credit utilization. Lenders see these individuals as low risk and are more likely to approve loans with the best interest rates and terms.

Credit score ranges play a crucial role in determining a borrower’s creditworthiness and the terms they receive on loans. Lenders use these ranges to assess the risk level associated with lending money to individuals, influencing loan approvals and interest rates offered. It’s essential for individuals to understand their credit score range and work towards improving it to secure better financial opportunities.

Improving Credit Score within Ranges

Improving your credit score, especially if it falls within the lower range, is crucial for better financial opportunities and lower interest rates. Here are some tips and strategies to help you boost your credit score and move towards a higher credit score range.

Tips for Improving Credit Score in the Lower Range

- Make timely payments on all your bills and debts to show responsible credit behavior.

- Reduce your credit utilization by paying down your credit card balances.

- Check your credit report regularly for errors and dispute any inaccuracies that may be lowering your score.

- Avoid opening new credit accounts frequently as it can negatively impact your score.

Strategies for Maintaining a Good Credit Score Range

- Set up automatic payments to ensure you never miss a due date.

- Keep your credit utilization ratio below 30% to show lenders you can manage credit responsibly.

- Avoid closing old credit accounts as they can help increase the average age of your credit history.

- Regularly monitor your credit score and address any issues promptly to prevent a drop in your score.

Actions to Take to Move from One Range to Another

- Focus on paying off high-interest debts first to lower your overall credit utilization.

- Consider a secured credit card to help build positive payment history if you have a limited credit history.

- Negotiate with creditors to settle any outstanding debts or work out a payment plan to improve your credit standing.

- Seek credit counseling or financial coaching to develop a plan for improving your credit score over time.

Comparison of Common Methods for Boosting Credit Scores Across Different Ranges

- In the lower range, focusing on timely payments and reducing credit utilization is crucial.

- For those in the mid-range, maintaining good credit habits and monitoring your score regularly can help you stay on track.

- Individuals in the higher range should continue practicing responsible credit behavior to preserve their excellent credit standing.

- Regardless of the range, checking your credit report and addressing any issues promptly is essential for overall credit health.