Diving into the world of credit card debt management, this introduction sets the stage for a deep exploration of strategies and tools to tackle financial challenges head-on. Brace yourself for a rollercoaster ride through the twists and turns of managing credit card debt like a boss.

In the following paragraphs, we’ll uncover the secrets to conquering credit card debt with finesse and determination, empowering you to take control of your financial future.

Introduction to Credit Card Debt Management

Credit card debt management involves strategies and techniques used to effectively handle and reduce the amount of debt accumulated through credit card usage. It is crucial for maintaining financial health and stability in the long run.

Importance of Credit Card Debt Management

- Prevents accumulation of high-interest debt

- Improves credit score and financial reputation

- Helps in achieving financial goals and stability

Challenges with Credit Card Debt

- Overspending and living beyond means

- High-interest rates leading to debt spiral

- Minimum payments prolonging debt repayment

Strategies for Managing Credit Card Debt

Credit card debt can be overwhelming, but there are strategies to help you take control of your finances and pay off what you owe.

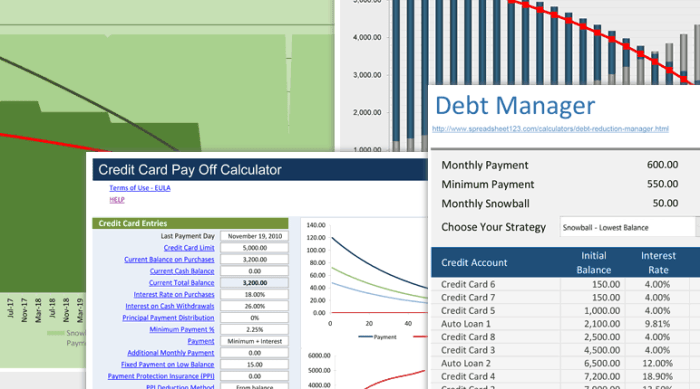

Snowball Method for Paying Off Debt

The snowball method involves paying off your debts from smallest to largest, regardless of interest rates. By focusing on smaller debts first, you can build momentum and motivation to tackle larger debts. Here’s how it works:

- List your debts from smallest to largest.

- Make minimum payments on all debts except the smallest one.

- Put any extra money towards paying off the smallest debt.

- Once the smallest debt is paid off, move on to the next smallest debt.

- Repeat this process until all debts are paid off.

Avalanche Method and How It Differs from Snowball Method

The avalanche method involves paying off debts with the highest interest rates first, regardless of the balance. This method can save you money on interest payments in the long run. Here’s how it differs from the snowball method:

- List your debts by interest rate, from highest to lowest.

- Make minimum payments on all debts except the one with the highest interest rate.

- Put any extra money towards paying off the debt with the highest interest rate.

- Once the debt with the highest interest rate is paid off, move on to the next highest one.

- Repeat this process until all debts are paid off.

Tips for Negotiating Lower Interest Rates

Negotiating lower interest rates with credit card companies can help you save money and pay off your debt faster. Here are some tips to help you negotiate:

- Call your credit card company and explain your situation.

- Ask if they can lower your interest rate, especially if you have a good payment history.

- Be polite and persistent in your request.

- Consider transferring your balance to a card with a lower interest rate if your current company is unwilling to negotiate.

Tools and Resources for Credit Card Debt Management

When it comes to managing credit card debt, having the right tools and resources can make a big difference in your financial journey. Here are some key resources to consider:

Budgeting Apps for Tracking Spending and Managing Debt

- Utilize budgeting apps like Mint, YNAB, or PocketGuard to track your spending habits and create a personalized budget.

- Set financial goals, monitor your credit score, and receive alerts for bill payments to stay on top of your finances.

- Track your credit card balances and transactions to identify areas where you can cut back and allocate more funds towards debt repayment.

Debt Consolidation Options and Impact on Credit Scores

- Consider debt consolidation through a personal loan or balance transfer credit card to combine multiple debts into one manageable payment.

- Understand that debt consolidation may impact your credit score initially, but can ultimately help improve it by reducing overall debt and streamlining payments.

- Compare interest rates, fees, and repayment terms of different consolidation options to choose the best fit for your financial situation.

Role of Credit Counseling Agencies in Debt Management

- Seek assistance from non-profit credit counseling agencies that offer free or low-cost financial education, budgeting assistance, and debt management plans.

- Credit counselors can negotiate with creditors on your behalf, help create a personalized debt repayment plan, and provide ongoing support and guidance.

- Be cautious of for-profit debt relief companies that may charge high fees and offer questionable solutions. Look for accredited agencies with a good track record of helping individuals manage debt effectively.

Avoiding Common Pitfalls in Credit Card Debt Management

When it comes to managing credit card debt, there are several common pitfalls that individuals should be aware of to ensure financial stability and avoid falling back into debt. By understanding the dangers of only making minimum payments, the risks of transferring balances between credit cards, and tips for avoiding relapsing into debt after paying it off, individuals can proactively manage their finances and stay on track towards financial freedom.

Dangers of Only Making Minimum Payments

- Making only minimum payments on credit card debt can significantly increase the total amount paid over time due to high-interest rates.

- It can prolong the repayment period, leading to a longer time spent in debt and potentially accumulating more debt in the process.

- Individuals may find themselves trapped in a cycle of minimum payments without making substantial progress towards paying off the debt.

Risks of Transferring Balances Between Credit Cards

- Transferring balances between credit cards can result in balance transfer fees and introductory interest rates that may increase over time.

- If individuals do not address the root cause of their debt, simply transferring balances can mask the underlying issue without providing a long-term solution.

- Constantly transferring balances can negatively impact credit scores and limit future borrowing options.

Tips for Avoiding Falling Back into Debt After Paying It Off

- Create a budget and stick to it to ensure expenses are in line with income and avoid overspending.

- Build an emergency fund to cover unexpected expenses and prevent the need to rely on credit cards in times of financial strain.

- Avoid unnecessary purchases and prioritize paying off high-interest debt to prevent accumulating new debt.