Ready to dive into the world of investing in gold? Buckle up as we explore the ins and outs of this shiny investment opportunity, from why it’s so popular to the different ways you can get in on the action. So, grab your notebooks and get ready to learn how to make your money work for you with gold investments.

In this guide, we’ll break down everything you need to know about investing in gold, covering types of gold investments, factors to consider before diving in, and the risks and challenges you might face along the way.

Introduction to Investing in Gold

Gold has been a popular investment choice for centuries due to its intrinsic value and stability. In times of economic uncertainty, investors often turn to gold as a safe haven asset to protect their wealth.

Benefits of Adding Gold to an Investment Portfolio

- Gold acts as a hedge against inflation, preserving purchasing power over time.

- Gold is a tangible asset that can provide diversification to a portfolio heavily weighted in stocks and bonds.

- Gold has historically maintained its value and served as a store of wealth during times of crisis.

- Gold can offer protection against geopolitical risks and currency fluctuations.

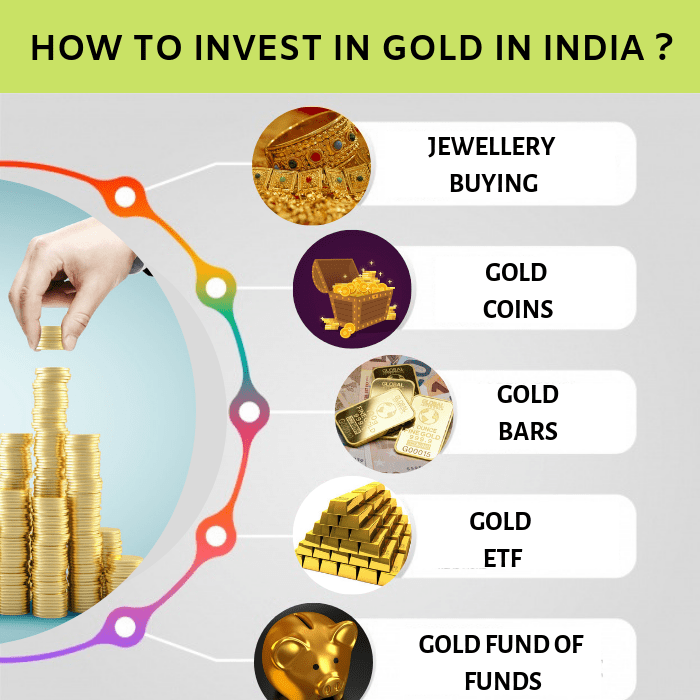

Different Ways to Invest in Gold

- Physical Gold: This includes buying gold coins, bars, or jewelry.

- Gold Exchange-Traded Funds (ETFs): These are investment funds that track the price of gold and can be traded on the stock exchange.

- Gold Futures and Options: These are financial derivatives that allow investors to speculate on the price of gold without owning the physical metal.

- Gold Mining Stocks: Investing in companies that mine gold can provide exposure to the potential upside of gold prices.

Historical Significance of Gold as an Investment

Throughout history, gold has been revered for its beauty, rarity, and value. Ancient civilizations used gold as a form of currency and a symbol of wealth. In modern times, gold has continued to play a significant role in the global economy as a safe haven asset and a means of preserving wealth.

Types of Gold Investments

Investing in gold can take different forms, each with its own set of pros and cons. It’s important to understand the various types of gold investments before diving in.

Physical Gold

Investing in physical gold involves purchasing actual gold in the form of coins, bars, or jewelry. One of the main advantages of owning physical gold is that you have direct ownership of the asset, providing a sense of security. However, storing and insuring physical gold can be costly and cumbersome.

Gold ETFs

Gold ETFs (Exchange-Traded Funds) are investment funds that track the price of gold and are traded on stock exchanges. One of the benefits of investing in gold ETFs is that they offer liquidity, making it easy to buy and sell shares. Additionally, ETFs eliminate the need for storing physical gold. On the downside, you don’t have direct ownership of the gold, and you are subject to management fees.

Gold Mining Stocks

Investing in gold mining stocks involves buying shares of companies that mine gold. This type of investment allows you to benefit from the performance of gold prices and the success of the mining company. However, investing in gold mining stocks comes with risks related to the company’s performance and market conditions.

How to Buy Physical Gold

When buying physical gold, it’s essential to purchase from reputable dealers to ensure authenticity. You can buy gold coins from government mints or private dealers, gold bars from banks or specialized dealers, and gold jewelry from trusted jewelers. Make sure to verify the purity and weight of the gold before making a purchase.

Investing in Gold ETFs

To invest in gold ETFs, you need to open a brokerage account and search for gold ETFs listed on stock exchanges. Once you find a suitable ETF, you can purchase shares through your brokerage account. Keep in mind that ETF prices fluctuate throughout the trading day, so it’s essential to monitor the market before making a trade.

Factors to Consider Before Investing in Gold

Investing in gold can be a smart move, but it’s essential to consider various factors before diving in. Let’s take a look at some key considerations that can influence your decision when it comes to investing in gold.

Factors Influencing the Price of Gold

- Supply and Demand: The basic economic principle of supply and demand plays a significant role in determining the price of gold. When demand is high and the supply is limited, the price tends to increase.

- Interest Rates: Gold prices often move inversely to interest rates. When interest rates are low, gold becomes a more attractive investment option, driving up its price.

- Market Volatility: Uncertain economic conditions and market volatility can lead investors to seek out safe-haven assets like gold, causing its price to rise.

Role of Inflation and Economic Conditions

- Inflation Hedge: Gold is often seen as a hedge against inflation, as its value typically increases when inflation rises. Investors turn to gold to protect their wealth in times of economic uncertainty.

- Economic Stability: Gold prices can be affected by the overall economic stability of a country or region. Political turmoil or economic crises can drive investors towards gold as a safe asset, pushing its price up.

Impact of Geopolitical Events

- Global Uncertainty: Geopolitical events such as wars, conflicts, or trade disputes can create uncertainty in the markets, leading investors to flock to gold as a safe-haven asset. This increased demand can drive up the price of gold.

Determining the Right Time to Invest in Gold

- Technical Analysis: Pay attention to technical indicators and charts to identify trends in gold prices. Look for patterns that may signal the right time to buy or sell.

- Market Conditions: Keep an eye on market conditions, economic indicators, and geopolitical events that could impact the price of gold. Consider diversifying your investment portfolio to mitigate risks.

- Long-Term vs. Short-Term: Decide whether you’re looking to invest in gold for the long term or short term. Your investment strategy will influence the timing of your gold purchases.

Risks and Challenges of Investing in Gold

Investing in gold comes with its own set of risks and challenges that investors need to be aware of. These factors can significantly impact the value of your investment and should be carefully considered before entering the market.

Volatility of Gold Prices

Gold prices are known to be volatile, meaning they can fluctuate rapidly and unpredictably. This volatility can be influenced by various factors such as economic conditions, geopolitical events, and market speculation. Investors in gold need to be prepared for sudden price swings that can affect the value of their investment.

Impact of Currency Fluctuations on Gold Investments

The value of gold is typically quoted in a specific currency, such as the US dollar. As a result, fluctuations in currency exchange rates can impact the value of your gold investment. If the currency in which gold is priced strengthens, the value of your gold investment may decrease, even if the actual price of gold remains constant.

Strategies to Mitigate Risks when Investing in Gold

To mitigate the risks associated with investing in gold, investors can consider diversifying their portfolio, setting clear investment goals, and staying informed about market trends. Diversification can help spread risk across different asset classes, reducing the impact of any single investment on your overall portfolio. Additionally, setting clear goals and staying informed can help investors make well-informed decisions and navigate the challenges of investing in gold effectively.