Ready to dive into the world of personal loans? Buckle up as we explore the ins and outs of securing that much-needed financial boost, with a touch of high school hip style to keep you hooked from start to finish.

In the next paragraph, we’ll break down the essential information you need to know about how to get a personal loan.

Researching Personal Loans

When looking into personal loans, it’s important to understand the different types available, factors to consider when choosing one, and the significance of checking your credit score beforehand.

Types of Personal Loans

- Secured Personal Loans: Require collateral, such as a car or savings account, which can lower interest rates.

- Unsecured Personal Loans: Based on creditworthiness without collateral, typically resulting in higher interest rates.

- Debt Consolidation Loans: Combine multiple debts into one loan for simplified repayment.

Factors to Consider

- Interest Rates: Compare rates from different lenders to find the most affordable option.

- Fees: Look out for origination fees, prepayment penalties, and other charges that can add to the cost of the loan.

- Repayment Terms: Consider the length of the loan and monthly payments to ensure they fit your budget.

Checking Your Credit Score

Before applying for a personal loan, check your credit score to understand your creditworthiness. A higher credit score can lead to better loan terms and lower interest rates, while a lower score may result in higher costs or rejection.

Applying for a Personal Loan

When applying for a personal loan, there are certain documents you will typically need to provide to the lender. These documents help the lender assess your financial situation and determine if you qualify for the loan.

Required Documents

- Identification documents such as a driver’s license or passport

- Proof of income like pay stubs or tax returns

- Bank statements to show your financial history

- Proof of address, such as a utility bill

- Information about any existing debts or loans

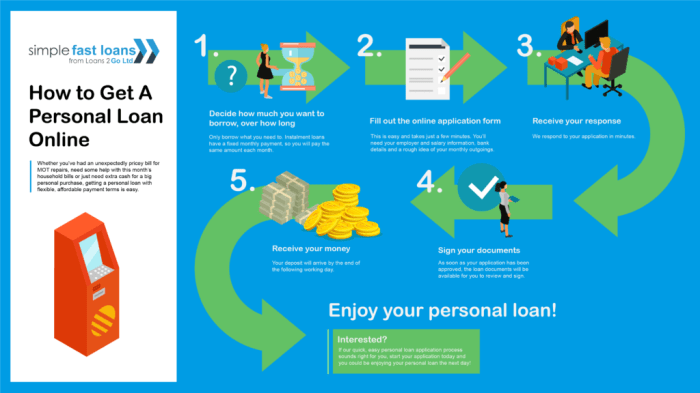

Application Process

- Choose a lender and fill out the application form

- Submit the required documents for verification

- Wait for the lender to review your application and make a decision

- If approved, review the loan terms and sign the agreement

- Receive the funds in your bank account

Comparing Interest Rates and Terms

When applying for a personal loan, it’s crucial to compare interest rates and terms from different lenders. This can help you find the best deal and save money in the long run. Make sure to consider factors like the APR, repayment term, and any additional fees before making a decision.

Qualifying for a Personal Loan

To qualify for a personal loan, you need to meet certain eligibility criteria set by lenders. Your income, employment history, and credit score play a significant role in determining whether you can secure a personal loan.

Income and Employment History

Having a stable source of income and a good employment history are crucial factors when applying for a personal loan. Lenders want to ensure that you have the financial capacity to repay the loan. A steady job with a consistent income stream increases your chances of getting approved for a personal loan. Lenders may ask for pay stubs or employment verification to assess your income stability.

Credit History

Your credit history is another important factor in qualifying for a personal loan. Lenders use your credit score to evaluate your creditworthiness and determine the interest rate they will offer you. A higher credit score indicates that you have a history of managing credit responsibly, making you a more favorable borrower. On the other hand, a low credit score may result in higher interest rates or even rejection of your loan application. It’s essential to maintain a good credit score by making timely payments and keeping your credit utilization low.

Managing and Repaying a Personal Loan

When it comes to managing and repaying a personal loan, it’s crucial to stay organized and on top of your payments to avoid any negative consequences. Here are some tips to help you successfully navigate this process.

Tips for Managing Your Personal Loan

- Create a budget to ensure you can make your monthly payments on time.

- Set up automatic payments to avoid missing any due dates.

- Avoid taking on additional debt while repaying your personal loan.

- Communicate with your lender if you encounter any financial difficulties.

Consequences of Missing Payments on a Personal Loan

Missing payments on your personal loan can have serious repercussions on your credit score and financial health. Not only will you incur late fees and penalties, but it can also lead to a negative impact on your credit report, making it harder to borrow in the future.

Strategies for Paying Off a Personal Loan Faster

- Make bi-weekly payments instead of monthly payments to reduce the overall interest paid.

- Use any windfalls or extra income to make additional payments towards your loan principal.

- Consider refinancing your loan for a lower interest rate if possible.

- Avoid extending the loan term to reduce the total amount paid over time.