Get ready to dive into the world of credit repair strategies. This paragraph sets the stage for an exciting journey filled with tips, tricks, and valuable insights that can help you take control of your financial future.

In this guide, we’ll explore the ins and outs of credit repair strategies, from understanding credit reports to DIY tips and working with credit repair agencies. So, buckle up and let’s start this credit repair adventure!

Introduction to Credit Repair Strategies

When it comes to your financial game, having solid credit is key. But what happens when your credit score isn’t hitting the right notes? That’s where credit repair strategies come into play, helping you tune up your credit profile and get back on track.

Credit repair strategies are all about taking proactive steps to improve your credit score. Whether you’ve had some rough patches in the past or simply want to boost your score for better financial opportunities, implementing effective credit repair strategies can make a world of difference.

Benefits of Implementing Effective Credit Repair Strategies

- Boosting your credit score: By addressing negative items on your credit report and building positive credit history, you can see a significant improvement in your credit score.

- Access to better financial opportunities: With a higher credit score, you may qualify for lower interest rates on loans, credit cards with better rewards, and even approval for a mortgage or car loan.

- Peace of mind: Knowing that you’re taking control of your financial future and working towards a healthier credit profile can bring a sense of security and peace of mind.

Impact of Credit Repair on Financial Health

Improving your credit score can open doors to better financial opportunities and save you money in the long run.

- Lower interest rates: With a higher credit score, lenders are more likely to offer you lower interest rates, saving you money on loans and credit card payments.

- Increased approval chances: A better credit score can increase your chances of approval for loans and credit cards, giving you access to the funds you need when you need them.

- Overall financial stability: By actively working on repairing your credit, you’re setting yourself up for a more stable financial future with improved access to credit and better financial options.

Understanding Credit Reports

A credit report is a detailed record of an individual’s credit history, including their borrowing and repayment activities. It serves as a crucial tool for lenders to assess a person’s creditworthiness and determine the risk of lending them money. The information in a credit report directly impacts an individual’s credit score, which plays a significant role in their ability to obtain loans, credit cards, and other financial products.

Key Components of a Credit Report

- Personal Information: This includes your name, address, social security number, and date of birth. It is essential to ensure this information is accurate and up to date.

- Credit Accounts: Details of your credit accounts, such as credit cards, loans, and mortgages, including the balances, payment history, and credit limits.

- Public Records: Any bankruptcies, foreclosures, tax liens, or other legal judgments that may impact your creditworthiness.

- Inquiries: Records of inquiries made by lenders when you apply for credit. Too many inquiries within a short period can negatively impact your credit score.

- Credit Utilization: The ratio of your credit card balances to their credit limits. It’s essential to keep this ratio low to maintain a healthy credit score.

Obtaining and Reviewing a Credit Report

It’s crucial to regularly obtain and review your credit report to ensure its accuracy and identify any potential errors that could be dragging down your credit score. You can request a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year through AnnualCreditReport.com. Review the report carefully, checking for any inaccuracies, outdated information, or signs of identity theft. Disputing errors promptly can help improve your credit score and overall financial health.

Common Credit Repair Strategies

When it comes to improving your credit score, there are several common strategies that individuals can use to address their financial situation and work towards a better credit standing. These strategies include debt consolidation, negotiation, and credit counseling.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan or payment plan. By consolidating debts, individuals can potentially lower their monthly payments and simplify their finances. This strategy can help individuals better manage their debt and improve their credit score over time.

Negotiation

Negotiation involves working with creditors to settle outstanding debts for less than the full amount owed. By negotiating with creditors, individuals can potentially reduce the total amount of debt they owe and improve their credit score by resolving delinquent accounts. Successful negotiation can lead to more manageable debt and a positive impact on credit scores.

Credit Counseling

Credit counseling involves working with a financial professional to create a personalized plan to address debt and improve credit. Credit counselors provide guidance on budgeting, debt management, and financial planning. By following a credit counselor’s advice, individuals can develop healthier financial habits and work towards a better credit score.

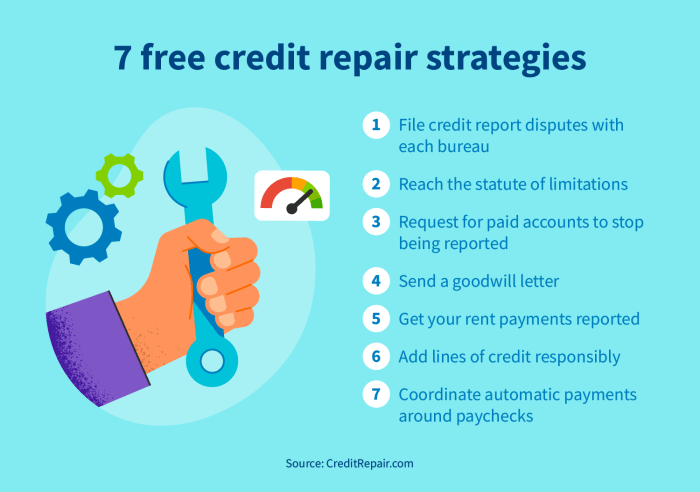

DIY Credit Repair Tips

When it comes to improving your credit score on your own, there are several key strategies you can implement. Taking control of your finances and being proactive in managing your credit can make a significant impact on your overall credit health. Let’s dive into some DIY credit repair tips to help you get started.

Importance of Budgeting and Financial Management

One of the foundational steps in repairing your credit is establishing a solid budget and practicing effective financial management. By creating a budget, you can track your income and expenses, identify areas where you can cut back on spending, and allocate funds towards paying off debts.

Remember, a well-managed budget can help you prioritize debt payments, avoid late payments, and ultimately improve your credit score over time.

Utilize Resources and Tools

- Monitor Your Credit: Regularly check your credit reports from all three major credit bureaus (Equifax, Experian, TransUnion) to identify any errors or discrepancies that may be affecting your score.

- Set Up Payment Reminders: Missing payments can have a negative impact on your credit score. Consider setting up automatic payment reminders or alerts to ensure you never miss a due date.

- Debt Repayment Strategies: Prioritize paying off high-interest debts first, consider debt consolidation or negotiation with creditors to lower interest rates, and explore balance transfer options to reduce overall debt burden.

- Seek Credit Counseling: If you’re struggling to manage your debts, consider working with a reputable credit counseling agency to develop a personalized debt repayment plan and improve your financial literacy.

Working with Credit Repair Agencies

When it comes to repairing your credit, working with a credit repair agency can be a game-changer. These agencies are experts in navigating the complex world of credit reports and scores, helping individuals improve their creditworthiness.

Pros and Cons of Working with Credit Repair Agencies

- Pros:

- Professional Expertise: Credit repair agencies have a deep understanding of credit laws and regulations, allowing them to effectively dispute inaccuracies on your credit report.

- Time-Saving: Instead of spending hours researching and contacting creditors yourself, a credit repair agency can handle these tasks for you.

- Potential for Faster Results: With their experience and resources, credit repair agencies may be able to achieve results quicker than if you were working on your own.

- Cons:

- Cost: Credit repair agencies typically charge fees for their services, which can add up over time.

- Lack of Control: By entrusting your credit repair process to an agency, you may have less control over the actions taken on your behalf.

- Potential for Scams: Not all credit repair agencies are legitimate, so it’s important to do thorough research before choosing one.

Tips for Choosing a Reputable and Effective Credit Repair Agency

- Do Your Research: Look for reviews, testimonials, and ratings online to gauge the reputation of the credit repair agency.

- Check Credentials: Ensure that the agency is licensed and bonded, and inquire about their experience in the industry.

- Transparency: A reputable agency should be transparent about their fees, services, and the expected timeline for results.

- Personalized Approach: Choose an agency that offers personalized solutions tailored to your specific credit repair needs.

Legal Aspects of Credit Repair

When it comes to credit repair, it’s crucial to understand the legal aspects that govern these practices. Knowing your rights as a consumer and being aware of common scams can help you navigate the process effectively.

Laws and Regulations

- One of the key laws governing credit repair is the Credit Repair Organizations Act (CROA), which sets guidelines for how credit repair companies can operate.

- Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute inaccurate information on their credit reports and have it corrected by the credit bureaus.

Common Scams and How to Avoid Them

- Beware of companies that promise a “quick fix” or guarantee a specific credit score increase. Legitimate credit repair takes time and there are no shortcuts.

- Avoid firms that ask for payment upfront before any services are rendered. According to the CROA, credit repair companies cannot charge fees until they have completed the promised services.

Consumer Rights in Credit Repair

- Consumers have the right to dispute inaccurate information on their credit reports and have the credit bureaus investigate and correct any errors.

- If a credit repair company violates your rights under the CROA, you have the right to take legal action and seek damages for any harm caused.