Yo, diving into compound interest investments, this intro will take you on a wild ride through the world of financial growth and savvy investment choices. Get ready for some serious money talk!

So, what exactly is compound interest and how does it work to help your money grow over time? Let’s break it down in a way that even your grandma would understand.

Definition of Compound Interest Investments

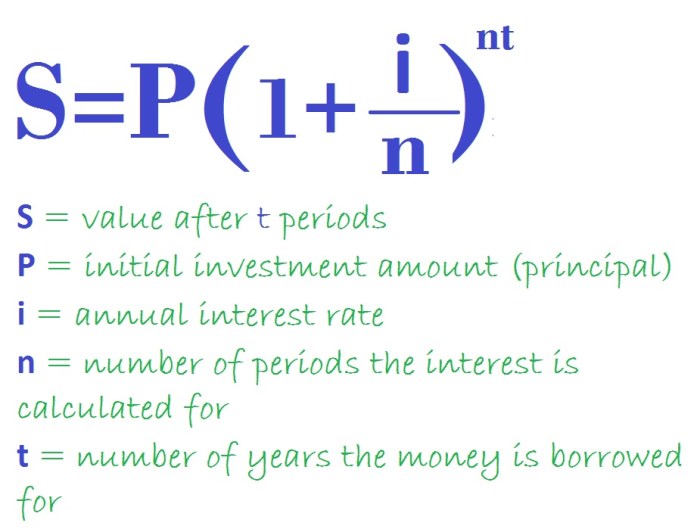

Compound interest in the context of investments refers to the process where the interest on an investment or loan is calculated based on the initial principal amount as well as the accumulated interest from previous periods. This means that over time, the interest is not only earned on the original investment but also on the interest that has been previously added to the principal.

How Compound Interest Works in Investment Scenarios

In investment scenarios, compound interest allows investors to earn interest on their initial investment as well as the interest already earned. For example, if you invest $100 in a savings account with an annual interest rate of 5%, at the end of the first year you would earn $5 in interest, bringing your total to $105. In the second year, you would earn 5% interest not just on the original $100 but on the $105 total, resulting in $5.25 in interest. This compounding effect continues to grow over time, accelerating the growth of your investment.

Benefits of Compound Interest Investments Over Time

- Accelerated Growth: Compound interest allows investments to grow at an increasing rate over time due to the compounding effect.

- Long-Term Wealth Building: By reinvesting the earned interest, investors can significantly increase their wealth over the long term.

- Passive Income Generation: Compound interest investments can provide a source of passive income as the investment grows over time.

- Power of Compounding: The longer the investment remains untouched, the greater the impact of compounding on the growth of the investment.

Types of Compound Interest Investments

Compound interest investments come in various forms, each with its own risk level and growth potential. It’s essential to understand the different types to make informed investment decisions.

Savings Accounts

Savings accounts are a common type of compound interest investment offered by banks. While they are low risk, the growth potential is limited due to low-interest rates compared to other investment options.

Certificates of Deposit (CDs)

CDs are another safe investment option that offers higher interest rates than savings accounts. However, they require locking in your funds for a specific period, limiting liquidity.

Stock Market Investments

Investing in the stock market can provide higher growth potential but comes with higher risk levels. Stock prices can be volatile, leading to potential losses if not carefully managed.

Real Estate Investments

Real estate investments can offer both rental income and property appreciation, making them a popular choice for long-term investors. However, they require a significant upfront investment and ongoing maintenance costs.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer a good balance of risk and return, making them a popular choice for many investors.

Factors Influencing Compound Interest Investments

Compound interest investments can be greatly affected by various factors that play a crucial role in determining the growth and returns on investments. Let’s delve into some key factors that influence compound interest investments.

Interest Rate Impact

The interest rate plays a significant role in determining the growth of investments through compound interest. A higher interest rate leads to faster growth of investments, as the interest is calculated on both the initial investment and the accumulated interest. On the other hand, a lower interest rate may result in slower growth and lower returns over time. It is essential to consider the interest rate carefully when making investment decisions to maximize the benefits of compound interest.

Role of Time

Time is a crucial factor in maximizing the benefits of compound interest investments. The longer the investment stays in place, the more time it has to grow exponentially through compounding. This means that starting investments early and letting them compound over a longer period can significantly increase the final amount accumulated. Time is a valuable asset in the world of compound interest, and the longer the time horizon, the greater the potential for growth.

Frequency of Compounding

The frequency of compounding refers to how often the interest is added to the principal amount in an investment. The more frequently the interest is compounded, the faster the investment grows. For example, investments that compound quarterly will grow faster than those that compound annually. Understanding the impact of compounding frequency is essential in maximizing investment returns, as even small differences in compounding frequency can lead to significant variations in the final amount accumulated.

Strategies for Maximizing Compound Interest Investments

Compound interest investments can be a powerful tool for long-term growth if utilized effectively. By employing the right strategies, investors can maximize their returns and build a strong portfolio. Let’s delve into some tips and examples on how to make the most out of compound interest investments.

Leveraging Compound Interest for Long-Term Growth

One of the key strategies to maximize compound interest investments is to start early and invest consistently. The power of compounding grows exponentially over time, so the sooner you start investing, the more you can benefit from it. By investing regularly and reinvesting your earnings, you can accelerate the growth of your investments.

Examples of Investment Strategies for Enhancing Compound Interest Returns

- 1. Reinvesting Dividends: Instead of cashing out dividends, reinvest them back into your investments. This will increase the principal amount, leading to higher returns over time.

- 2. Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of market conditions, can help smooth out market fluctuations and maximize returns in the long run.

- 3. Compounding Frequency: Opt for investments that compound more frequently, such as monthly or quarterly, to accelerate the growth of your investments.

The Importance of Diversification in a Compound Interest Investment Portfolio

Diversification is crucial in a compound interest investment portfolio to mitigate risk and maximize returns. By spreading your investments across different asset classes and industries, you can reduce the impact of market volatility on your portfolio. A well-diversified portfolio can help you achieve more stable and consistent returns over time, enhancing the power of compound interest.