Get ready to dive into the world of FICO scores, where numbers hold the key to financial success. From unraveling the calculation process to exploring the impact on loan approvals, this topic is your gateway to financial freedom.

Let’s break down the essentials of FICO scores and how they play a crucial role in shaping our financial journeys.

Understanding FICO Scores

FICO scores are numerical representations of an individual’s creditworthiness, which play a crucial role in determining their ability to access credit and the terms of that credit. These scores are used by lenders to assess the risk of lending money to a particular individual.

Calculation of FICO Scores

FICO scores are calculated based on several factors, including payment history, amounts owed, length of credit history, new credit, and types of credit used. These factors are weighted differently, with payment history carrying the most significant weight.

- Payment History: This accounts for about 35% of the FICO score and reflects whether payments have been made on time.

- Amounts Owed: This makes up around 30% of the score and considers the amount owed on different types of accounts.

- Length of Credit History: About 15% of the score is based on the length of time credit accounts have been open.

- New Credit: This factor makes up approximately 10% and looks at the number of new accounts and credit inquiries.

- Types of Credit Used: The final 10% of the score considers the mix of credit accounts an individual has, such as credit cards and loans.

Importance of FICO Scores

FICO scores are crucial for both individuals and lenders. For individuals, having a high FICO score can lead to lower interest rates on loans, better credit card offers, and increased chances of loan approval. On the other hand, lenders rely on FICO scores to assess the risk associated with lending money and determine the terms of credit they offer.

Impact on Loan Approvals and Interest Rates

A higher FICO score generally leads to easier loan approvals and better interest rates, as it signals to lenders that the individual is a low-risk borrower. For example, someone with an excellent credit score may qualify for a mortgage with a lower interest rate compared to someone with a lower score. Additionally, individuals with lower scores may face challenges in getting approved for loans or may have to pay higher interest rates to compensate for the perceived risk.

Factors Influencing FICO Scores

Understanding the key factors that influence FICO scores is crucial for managing your credit health and financial well-being. These factors play a significant role in determining your creditworthiness and overall credit score.

Payment History

Your payment history is one of the most important factors that influence your FICO score. It accounts for approximately 35% of your total score. Lenders want to see a consistent record of on-time payments, as missed or late payments can significantly lower your score. A history of timely payments can boost your credit score and demonstrate your reliability as a borrower.

Credit Utilization

Credit utilization refers to the ratio of your credit card balances to your credit limits. This factor makes up about 30% of your FICO score. Keeping your credit utilization low, ideally below 30%, shows lenders that you are responsible with your credit and can manage your debts effectively. High credit utilization can negatively impact your score, so it’s important to keep this ratio in check.

Credit Inquiries and Types of Credit

Credit inquiries and the types of credit you have also influence your FICO score. Credit inquiries occur when you apply for new credit, and they can have a temporary impact on your score. Multiple inquiries within a short period may raise red flags to lenders. Additionally, having a mix of credit types, such as credit cards, installment loans, and mortgages, can positively impact your score by showing that you can manage various types of credit responsibly.

Improving FICO Scores

To boost your FICO score, you need to focus on making timely payments, reducing credit card balances, and managing credit responsibly.

Make Timely Payments

- Missing payments can significantly lower your FICO score, so always pay on time.

- Set up automatic payments or reminders to ensure you never miss a due date.

- Even one late payment can have a negative impact on your score, so make it a priority to be punctual.

Reduce Credit Card Balances

- High credit card balances can hurt your FICO score, aim to keep your credit utilization low.

- Try to pay off your balances in full each month to avoid carrying over debt.

- Consider spreading out your balances across multiple cards to keep individual card utilization low.

Manage Credit Responsibly

- Avoid opening multiple new credit accounts at once as this can lower the average age of your accounts.

- Regularly check your credit report for errors and address them promptly to prevent any negative impact on your score.

- Only apply for credit when necessary and be cautious with how much credit you utilize to keep your score healthy.

Monitoring and Understanding FICO Scores

Monitoring your FICO score is crucial for staying on top of your financial health. By regularly checking your score, you can track your progress and identify any red flags that may need attention.

Significance of Checking FICO Scores Regularly

- Regularly monitoring your FICO scores can help you detect any errors or fraudulent activity on your credit report.

- It allows you to see how your financial decisions are impacting your creditworthiness.

- Checking your FICO score regularly can help you identify areas for improvement and take steps to boost your score.

Differences Between FICO Scores and Credit Reports

- Your FICO score is a three-digit number that represents your credit risk based on information from your credit report.

- A credit report is a detailed record of your credit history, including your payment history, credit utilization, and account information.

- While your FICO score is based on the information in your credit report, they are not the same thing.

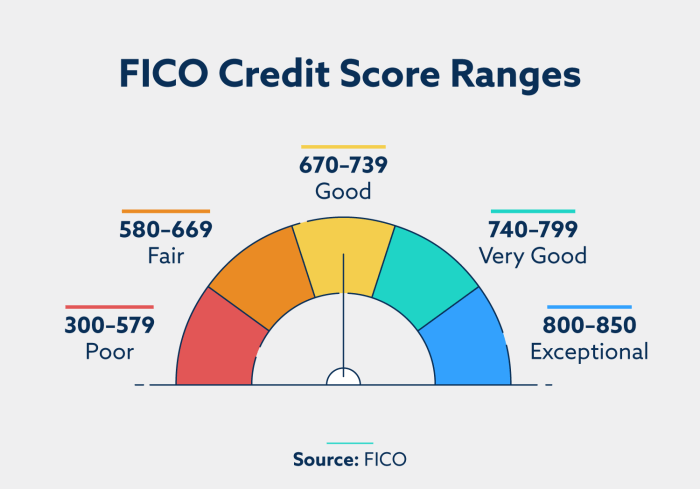

Interpreting FICO Score Ranges and Variations

- FICO scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

- A score above 700 is generally considered good, while a score below 600 may raise concerns for lenders.

- Factors such as payment history, credit utilization, and length of credit history can all impact your FICO score.