Diving deep into the world of credit scores, buckle up as we take a ride through the importance, factors, and strategies surrounding this crucial financial element. Get ready to level up your credit game!

Let’s break down the key components that make up your credit score and how they can impact your financial well-being.

Importance of Credit Scores

Having a good credit score is crucial for maintaining a healthy financial status. It is a numerical representation of your creditworthiness and can greatly impact various aspects of your financial life.

Impact on Loan Approvals

- When applying for a loan, lenders often look at your credit score to determine your likelihood of repaying the borrowed amount.

- A higher credit score increases your chances of getting approved for a loan, while a lower score may result in rejection.

- For example, a mortgage lender may require a minimum credit score to qualify for a home loan.

Role in Determining Interest Rates

- Credit scores also play a significant role in determining the interest rates you receive on loans and credit cards.

- Borrowers with higher credit scores are typically offered lower interest rates, saving them money over the life of the loan.

- On the other hand, individuals with lower credit scores may face higher interest rates, leading to increased costs over time.

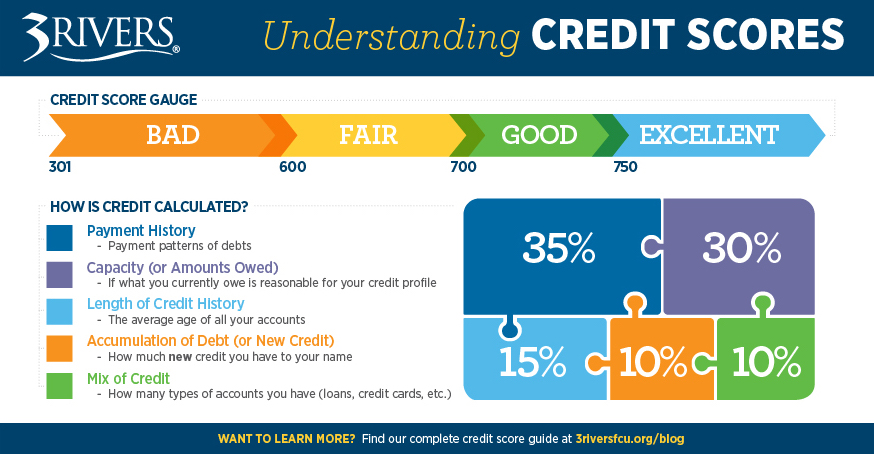

Factors Affecting Credit Scores

When it comes to credit scores, several key factors play a significant role in determining an individual’s creditworthiness. Understanding these factors is essential for maintaining a good credit score and financial health.

Payment History

Payment history is one of the most critical factors that influence credit scores. It accounts for approximately 35% of the total credit score calculation. Lenders want to see if you have a history of making on-time payments on your credit accounts. Late payments, defaults, or accounts sent to collections can have a negative impact on your credit score. Consistently paying your bills on time can help improve your credit score over time.

Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount of credit available to you. It is another significant factor affecting credit scores, contributing around 30% to the overall score. Keeping your credit utilization ratio low, ideally below 30%, demonstrates responsible credit management and can positively impact your credit score. High credit utilization can signal financial distress and may result in a lower credit score.

Improving Credit Scores

To improve a low credit score, it’s essential to focus on making timely payments, reducing credit card balances, and being mindful of credit utilization.

Make Payments on Time

One of the most important factors in improving a credit score is making payments on time. Late payments can significantly impact your score, so be sure to pay all bills by their due dates.

Reduce Credit Card Balances

High credit card balances can negatively affect your credit score. To boost your score, aim to reduce your balances to below 30% of your available credit limit. This shows lenders that you are responsible with your credit usage.

Monitoring Credit Scores

Regularly monitoring credit scores is crucial for maintaining financial health and awareness of one’s creditworthiness. It allows individuals to track changes, identify discrepancies, and take necessary actions to protect their credit standing.

Tools and Services for Checking Credit Scores

- Credit Monitoring Services: Companies like Credit Karma, Experian, and TransUnion offer free credit score monitoring services with regular updates and alerts.

- Annual Credit Report: Consumers are entitled to a free credit report from each of the major credit bureaus once a year through AnnualCreditReport.com.

- Credit Card Providers: Many credit card companies provide access to credit scores as part of their cardholder benefits.

Early Detection of Identity Theft

Regularly monitoring credit scores can help detect signs of identity theft early on, such as sudden drops in credit scores, unfamiliar accounts, or unauthorized inquiries. By catching these issues promptly, individuals can take immediate steps to dispute fraudulent activities and safeguard their financial reputation.