Diving into the world of loans, one term stands out among the rest – APR. But what exactly does it mean and why is it crucial for borrowers to grasp its significance? Let’s break it down and uncover the secrets behind understanding APR on loans.

As we delve deeper into the realm of APR, we’ll explore how this seemingly simple acronym holds the key to unlocking the true cost of borrowing money.

Understanding APR on Loans

When it comes to loans, APR is the real deal. It stands for Annual Percentage Rate, and it’s like the ultimate price tag for borrowing money. Basically, it shows you the total cost of the loan, including interest rates and fees, expressed as a yearly percentage.

Calculating APR on Different Types of Loans

- For credit cards: APR includes interest rates and other charges, like annual fees or balance transfer fees. It’s calculated based on the average daily balance.

- For mortgages: APR takes into account interest rates, points, broker fees, and other charges, giving you a more accurate picture of the total cost over the loan term.

- For personal loans: APR considers interest rates and any origination fees, showing you the full cost of borrowing.

Importance of Understanding APR for Borrowers

Knowing the APR is crucial for borrowers to make informed decisions. It helps you compare loan offers from different lenders and understand the true cost of borrowing. A lower APR means you’ll pay less in interest over time, saving you money in the long run.

Remember, a low APR is like hitting the loan jackpot!

Differences between APR and Interest Rate

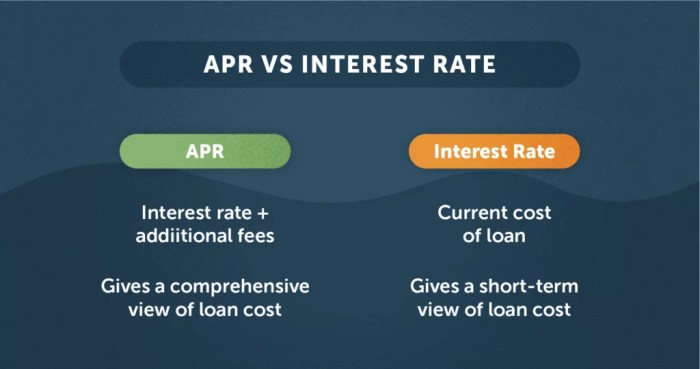

When it comes to loans, understanding the differences between APR and interest rate is crucial for making informed financial decisions. While both are important factors in determining the overall cost of borrowing money, they serve different purposes and include different components.

APR vs. Interest Rate

Interest rate refers to the percentage of the principal loan amount that lenders charge borrowers for borrowing money. It represents the cost of borrowing and is a key factor in determining the monthly payment amount.

On the other hand, APR, or Annual Percentage Rate, includes not only the interest rate but also any additional fees or charges that may be associated with the loan, such as origination fees, closing costs, and other expenses. The APR provides a more comprehensive view of the total cost of borrowing, making it a more accurate measure of the true cost of a loan.

When evaluating loan offers, both the APR and interest rate play important roles. While the interest rate gives you a basic idea of how much you’ll be paying in interest, the APR provides a more complete picture by taking into account all the associated costs. This means that a loan with a lower interest rate may end up costing more overall if it has a higher APR due to additional fees.

Factors Influencing APR

When it comes to determining the APR on loans, several key factors come into play. These factors can greatly impact the overall cost of borrowing money and ultimately affect the borrower’s financial situation.

Credit Score

Your credit score plays a significant role in determining the APR you will be offered on a loan. Typically, borrowers with higher credit scores are seen as less risky by lenders, which means they are more likely to receive a lower APR. On the other hand, borrowers with lower credit scores may be offered higher APRs to offset the perceived risk of lending to them.

Loan Term

The length of the loan term also influences the APR. Generally, loans with longer terms tend to have higher APRs compared to shorter-term loans. This is because longer loan terms expose lenders to a higher risk of default, leading to higher interest rates to compensate for this risk.

Loan Amount

The amount of the loan can impact the APR as well. Larger loan amounts may come with lower APRs compared to smaller loan amounts. Lenders may offer better rates for larger loans since they stand to make more money in interest over the life of the loan.

Shopping Around for Loans

One of the best ways to secure a better APR on a loan is by shopping around and comparing offers from different lenders. By obtaining quotes from multiple lenders, borrowers can find the most competitive rates available to them. This not only helps in getting a better APR but also ensures that borrowers are making an informed decision when choosing a loan.

Reading the Fine Print

When it comes to understanding APR on loans, reading the fine print is crucial. This is where you can uncover hidden fees, clauses, and terms that can significantly impact the overall cost of borrowing money.

Tips for Reading the Fine Print

- Pay attention to the Annual Percentage Rate (APR) and not just the interest rate. The APR includes all costs associated with the loan, giving you a more accurate picture of how much you will pay.

- Look for any prepayment penalties or fees for paying off the loan early. These can add extra costs if you plan to settle the loan ahead of schedule.

- Check for any fees for late payments, as missing payments can lead to additional charges and higher overall costs.

- Review the repayment terms, including the length of the loan and the monthly payment amounts. Make sure you understand when payments are due and how they will be calculated.

Common Hidden Fees and Clauses

- Origination fees: These are charges for processing the loan and are typically a percentage of the total loan amount.

- Application fees: Some lenders may require a fee to process your loan application, which can add to the overall cost.

- Variable interest rates: Be aware of loans with variable rates that can change over time, potentially increasing your payments.

- Automatic payment clauses: Some loans may require automatic payments from your bank account, so make sure you are comfortable with this arrangement.

Importance of Reviewing Terms and Conditions

- By carefully reviewing all terms and conditions before accepting a loan offer, you can avoid surprises and make informed decisions about your borrowing.

- Understanding the fine print can help you compare different loan offers and choose the one that best fits your financial situation.

- Take the time to ask questions and seek clarification on any terms you don’t understand to ensure you are fully aware of what you are agreeing to.