Get ready to dive into the realm of variable interest rate loans, where the financial game is always changing and keeping you on your toes. From the benefits to the risks, we’ll break it down in a way that’s as cool as your favorite playlist.

So, buckle up as we explore the ins and outs of variable interest rate loans and how they can shake up your financial landscape.

Introduction to Variable Interest Rate Loans

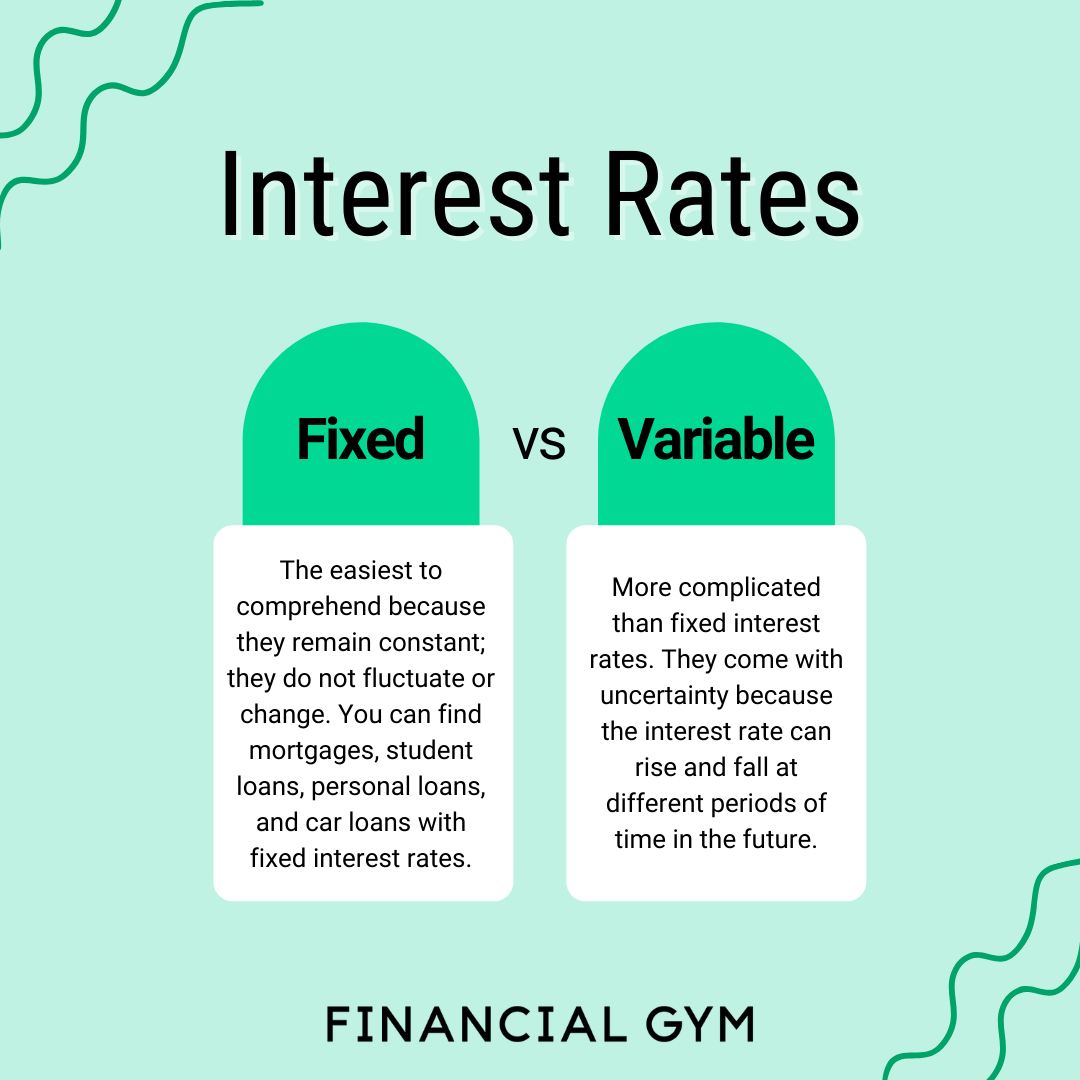

Variable interest rate loans are loans where the interest rate can change over time, usually based on fluctuations in the market. Unlike fixed-rate loans, the interest rate on variable rate loans can go up or down, impacting the monthly payments for the borrower.

Some financial institutions that offer variable interest rate loans include Wells Fargo, Bank of America, and Chase. These loans are popular for mortgages and student loans, as they often come with lower initial interest rates compared to fixed-rate loans.

Benefits of Variable Interest Rate Loans

- Lower initial interest rates

- Potential for lower payments if interest rates decrease

- May benefit borrowers in a falling interest rate environment

Risks of Variable Interest Rate Loans

- Payments can increase if interest rates rise

- Uncertainty in monthly budgeting due to fluctuating rates

- Potential for higher overall interest payments if rates increase significantly

Factors Affecting Variable Interest Rates

Variable interest rates can be influenced by various factors that play a crucial role in determining the fluctuations in these rates. Understanding these factors is essential for borrowers looking to secure a variable rate loan.

Economic conditions have a significant impact on the fluctuation of variable interest rates. When the economy is performing well, with low unemployment rates and high consumer spending, interest rates tend to rise. On the other hand, during economic downturns or recessions, central banks may lower interest rates to stimulate economic growth. This constant adjustment based on economic indicators can lead to changes in variable interest rates.

Central bank policies also play a critical role in affecting variable interest rates. Central banks use monetary policy tools to control the money supply, inflation, and overall economic growth. By adjusting interest rates, central banks can influence borrowing costs for consumers and businesses. For example, if a central bank decides to increase interest rates to combat inflation, borrowers with variable rate loans may see an increase in their interest payments.

Impact of Inflation on Variable Interest Rates

Inflation is a key factor that can impact variable interest rates. As inflation rises, the purchasing power of a currency decreases, leading to higher prices for goods and services. To combat the effects of inflation, central banks may increase interest rates, causing variable interest rates to rise for borrowers.

Global Economic Events and Variable Interest Rates

Global economic events such as trade wars, geopolitical tensions, or natural disasters can also impact variable interest rates. Uncertainty in the global economy can lead to fluctuations in interest rates as investors seek safe-haven assets, affecting the overall borrowing costs for variable rate loans.

Pros and Cons of Variable Interest Rate Loans

When considering variable interest rate loans, it’s important to weigh the advantages and disadvantages to make an informed decision. Variable interest rates can offer flexibility, but they also come with risks that need to be carefully considered.

Advantages of Variable Interest Rate Loans

- Flexibility: Variable interest rates can fluctuate based on market conditions, which means your interest payments could potentially decrease if interest rates go down.

- Potential for Savings: In a low-interest rate environment, variable rate loans may offer lower initial rates compared to fixed-rate loans, potentially saving you money in the short term.

- Early Repayment Benefits: Variable rate loans often have more favorable terms for early repayment without incurring high penalties.

Disadvantages of Variable Interest Rate Loans

- Uncertainty: The main drawback of variable rate loans is the uncertainty of future interest rate fluctuations, which can lead to higher payments if rates increase.

- Financial Risk: If interest rates rise significantly, your monthly payments could become unaffordable, putting financial strain on your budget.

- Budgeting Challenges: Variable rates make it harder to predict your long-term financial commitments, making budgeting more challenging.

Scenarios to Opt for Variable Interest Rate Loans

- Short-Term Financing: If you only need the loan for a short period and believe interest rates will remain stable or decrease, a variable rate loan could be a cost-effective choice.

- Ability to Refinance: If you have the flexibility to refinance or pay off the loan early, you can take advantage of lower initial rates on a variable rate loan without worrying about long-term rate increases.

- Risk Tolerance: If you are comfortable with financial uncertainty and have the ability to absorb potential payment increases, a variable rate loan may suit your risk tolerance level.

Managing Risks with Variable Interest Rate Loans

When it comes to variable interest rate loans, managing risks is crucial to avoid financial pitfalls. Here are some strategies to help borrowers navigate the uncertainties that come with variable interest rates.

Budgeting Effectively

Effective budgeting is key when dealing with variable interest rates. Borrowers should allocate a portion of their budget towards potential rate increases to ensure they can still afford their loan payments. Setting aside an emergency fund can also provide a safety net in case rates rise unexpectedly.

Monitoring and Predicting Rate Changes

Staying informed about economic indicators and market trends can help borrowers anticipate potential changes in variable interest rates. Regularly checking in with financial advisors or monitoring financial news can provide valuable insights into when rates might increase or decrease. Additionally, keeping track of the loan’s adjustment periods and caps can help borrowers prepare for any fluctuations in interest rates.

Diversifying Loan Portfolio

One way to manage risks associated with variable interest rate loans is to diversify your loan portfolio. By spreading out your loans across different types of interest rates (fixed and variable) and loan terms, you can mitigate the impact of rate fluctuations on your overall financial health. This strategy can help balance the risks and rewards of variable interest rate loans.