When it comes to secured vs unsecured loans, buckle up as we dive into the nitty-gritty details of these financial options. Get ready for a rollercoaster ride of information that will leave you well-equipped to make informed decisions about your borrowing needs.

In the following paragraphs, we will break down the key differences between secured and unsecured loans, shedding light on their pros and cons, eligibility requirements, and more.

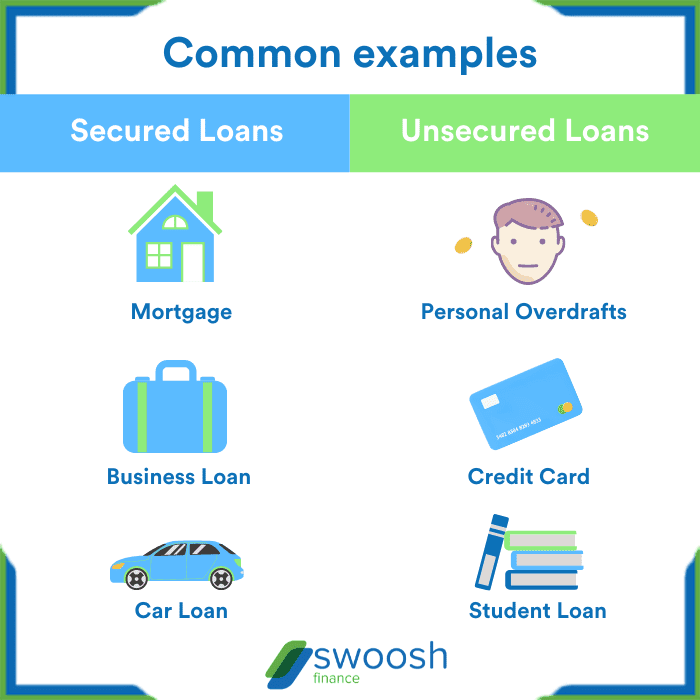

Secured Loans

Secured loans are loans that are backed by collateral, which is an asset that the borrower owns and offers as a guarantee to the lender in case they are unable to repay the loan. This collateral reduces the risk for the lender, allowing them to offer lower interest rates compared to unsecured loans.

Assets as Collateral

- Real estate properties (homes, land)

- Automobiles

- Investment accounts

- Jewelry

- Valuables (artwork, antiques)

Advantages and Disadvantages

- Advantages:

- Lower interest rates

- Higher borrowing limits

- Easier approval process

- Potential for longer repayment terms

- Disadvantages:

- Risk of losing the collateral if unable to repay

- Time-consuming appraisal process for collateral

- May require a good credit score

- Restrictions on how the loan funds can be used

Unsecured Loans

When it comes to unsecured loans, these are loans that do not require collateral to secure the funds borrowed. Unlike secured loans that are backed by assets like a home or car, unsecured loans are approved based on the borrower’s creditworthiness.

Typical Requirements for Obtaining an Unsecured Loan

When applying for an unsecured loan, lenders typically look at factors such as:

- Credit Score: A good credit score is usually required to qualify for an unsecured loan.

- Income: Lenders want to ensure that borrowers have a steady income to repay the loan.

- Debt-to-Income Ratio: Lenders assess the borrower’s debt compared to their income to determine if they can afford the loan.

Comparison of Interest Rates Between Secured and Unsecured Loans

Interest rates for unsecured loans are typically higher than those for secured loans. This is because unsecured loans pose a higher risk to lenders since there is no collateral to recover in case of default. On the other hand, secured loans have lower interest rates because the collateral reduces the risk for the lender.

Collateral

When it comes to secured loans, collateral plays a crucial role in the borrowing process. Collateral is an asset that the borrower pledges to the lender to secure the loan, providing a form of security for the lender in case the borrower defaults on the loan.

Importance of Collateral in Secured Loans

Collateral is essential in secured loans as it reduces the risk for the lender, allowing them to offer lower interest rates and higher loan amounts. By having an asset to secure the loan, the lender has a way to recoup their losses if the borrower fails to repay the loan.

- Collateral provides a sense of security for the lender, increasing the likelihood of loan approval.

- It allows borrowers with lower credit scores or limited credit history to qualify for loans.

- Collateral-backed loans often have more favorable terms compared to unsecured loans.

Risks Associated with Using Collateral for a Loan

While collateral offers benefits, there are risks involved in using assets to secure a loan. If the borrower defaults on the loan, they risk losing the collateral, which could be their home, car, or savings.

- Defaulting on a secured loan can lead to the loss of the collateral, impacting the borrower’s financial stability.

- If the value of the collateral drops, the borrower may be required to provide additional security or pay off the loan to avoid default.

- Certain assets used as collateral may have sentimental value, making their loss emotionally challenging for the borrower.

Tips on Choosing the Right Collateral for a Secured Loan

Selecting the appropriate collateral is crucial to ensure that the asset aligns with the loan amount and repayment terms. Here are some tips for choosing the right collateral for a secured loan:

- Assess the value of the collateral to ensure it meets or exceeds the loan amount.

- Choose an asset that is easily marketable and has a stable value to minimize risks.

- Consider the impact of losing the collateral and select an asset that you can afford to lose if necessary.

Eligibility Criteria

Secured loans typically have more lenient eligibility criteria compared to unsecured loans. This is because the presence of collateral reduces the risk for the lender, making it easier for individuals to qualify for secured loans.

Common Eligibility Criteria for Secured Loans

- Good credit score

- Sufficient income to cover loan payments

- Valuable collateral to secure the loan

- Stable employment history

Assessment of Eligibility for Unsecured Loans

Unsecured loans rely heavily on the borrower’s creditworthiness since there is no collateral involved. Lenders assess eligibility for unsecured loans based on the borrower’s credit score, income, employment status, and overall financial health.

Comparison of Approval Process

| Secured Loans | Unsecured Loans |

|---|---|

| Likely easier to get approved due to collateral | Harder to qualify for without collateral |

| Less emphasis on credit score | Requires a good credit score for approval |

| Longer approval process due to collateral evaluation | Quicker approval process but with stricter criteria |