Diving into the world of mortgage loan rates today, get ready for a wild ride filled with twists and turns that will keep you on the edge of your seat.

Get ready to explore the ins and outs of mortgage loan rates, from how they’re calculated to why they matter in today’s financial landscape.

Overview of Mortgage Loan Rates Today

When it comes to buying a home, mortgage loan rates play a crucial role in determining how much you’ll pay over the life of your loan. These rates represent the interest charged on a mortgage loan, influencing your monthly payments and overall affordability.

What are Mortgage Loan Rates?

Mortgage loan rates are the interest rates that lenders charge borrowers for taking out a mortgage loan to purchase a home. These rates can vary based on several factors, including the borrower’s credit score, the loan amount, the term of the loan, and current market conditions.

How are Mortgage Loan Rates Determined?

Mortgage loan rates are determined by a combination of factors, including the Federal Reserve’s monetary policy, inflation rates, the bond market, and the overall state of the economy. Lenders also take into account the borrower’s creditworthiness and financial history when setting the interest rate for a mortgage loan.

The Significance of Monitoring Mortgage Loan Rates

Monitoring mortgage loan rates is essential for anyone looking to buy a home or refinance their existing mortgage. By keeping an eye on these rates, borrowers can take advantage of lower rates to save money on interest payments over time. Even a small decrease in the interest rate can result in significant savings throughout the life of the loan.

Factors Influencing Mortgage Loan Rates Today

When it comes to mortgage loan rates today, there are several key factors that play a significant role in determining the rates that borrowers will be offered. These factors can affect whether rates go up or down, ultimately impacting the overall cost of borrowing for individuals seeking a mortgage.

One of the main factors influencing mortgage loan rates today is the overall state of the economy. When the economy is strong and growing, interest rates tend to rise as demand for loans increases. On the other hand, during economic downturns or times of uncertainty, rates may decrease to stimulate borrowing and spending. The Federal Reserve also plays a crucial role in setting short-term interest rates, which can influence mortgage rates as well.

Another factor that impacts mortgage loan rates is inflation. When inflation is high, lenders may increase rates to compensate for the decreased purchasing power of the dollar over time. Conversely, low inflation rates may lead to lower mortgage rates as lenders do not need to adjust for significant decreases in the value of money.

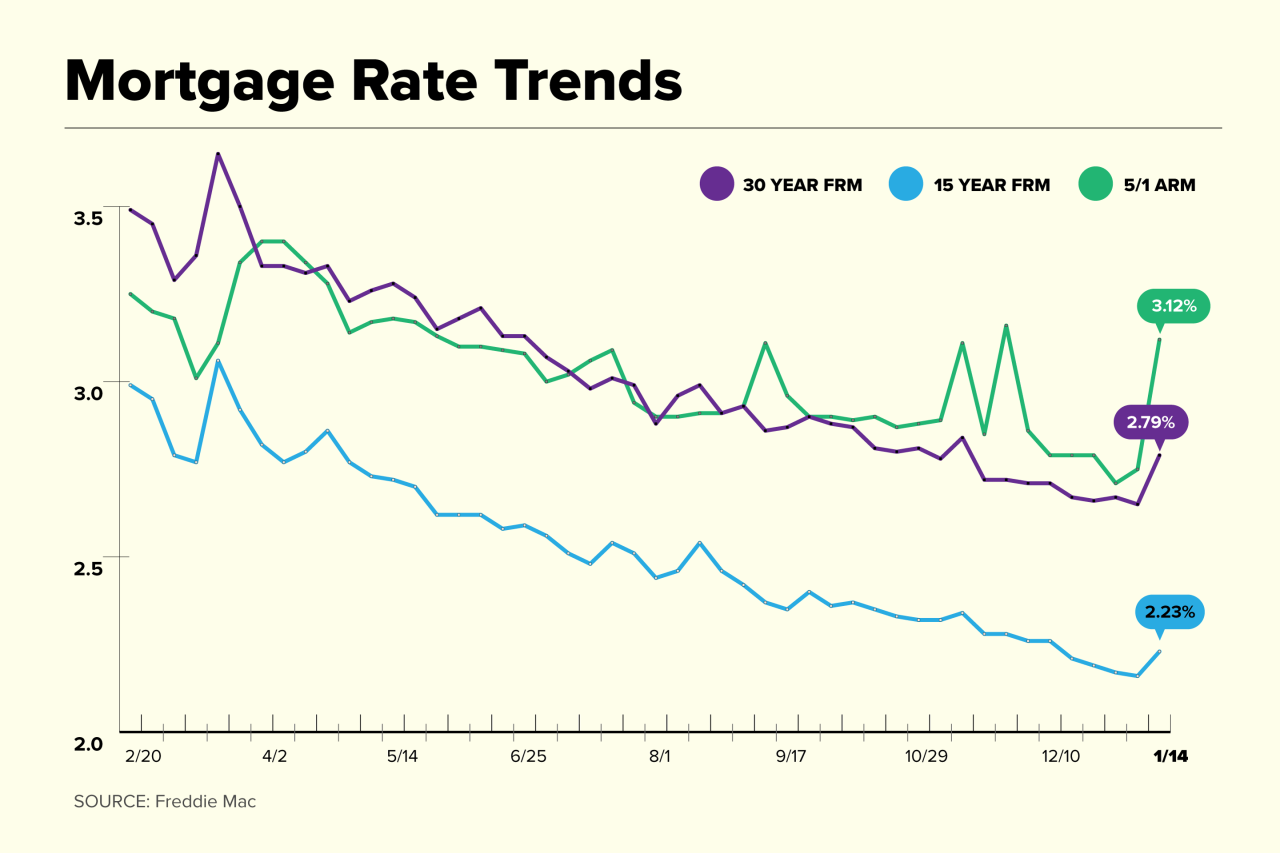

Additionally, the type of mortgage loan chosen by a borrower can also affect the interest rate offered. Fixed-rate mortgages have a set interest rate that remains constant throughout the life of the loan, providing predictability and stability for borrowers. In contrast, adjustable-rate mortgages (ARMs) have interest rates that can fluctuate based on market conditions, leading to potential savings or increased costs depending on the direction of interest rates.

Comparison of Fixed-Rate and Adjustable-Rate Mortgage Loan Rates

- Fixed-Rate Mortgages:

- Offer stability and predictability in monthly payments.

- Interest rates remain constant throughout the loan term.

- May have higher initial rates compared to ARMs.

- Adjustable-Rate Mortgages:

- Initial interest rates are typically lower than fixed-rate mortgages.

- Rates can adjust periodically based on market conditions.

- Borrowers may benefit from lower rates if interest rates decrease.

How the Economy Impacts Mortgage Loan Rates

- The state of the economy, including factors like GDP growth, unemployment rates, and inflation, can influence mortgage rates.

- During economic expansions, rates may rise due to increased demand for loans and higher inflation expectations.

- In times of economic uncertainty or recession, rates may fall as the Federal Reserve implements monetary policies to stimulate borrowing and spending.

- Global economic conditions and geopolitical events can also impact mortgage rates by affecting investor confidence and market stability.

Importance of Monitoring Mortgage Loan Rates

Keeping an eye on mortgage loan rates is crucial for anyone looking to buy a home or refinance their current mortgage. Fluctuations in these rates can have a significant impact on your monthly payments and overall financial situation. By staying informed, you can take advantage of lower rates to save money in the long run.

Why Stay Updated on Mortgage Loan Rates

- Tracking changes in mortgage loan rates allows you to seize opportunities when rates drop, helping you secure a lower interest rate on your loan.

- Being aware of rate trends can help you plan your home buying or refinancing process more effectively, ensuring you make the best financial decision at the right time.

- Monitoring rates can also help you avoid missing out on potential savings or paying more than necessary over the life of your loan.

Tips for Tracking Mortgage Loan Rates

- Regularly check financial news websites, mortgage lender websites, and online rate comparison tools to stay updated on current rates.

- Consider setting up rate alerts or notifications to receive instant updates when rates change, allowing you to act quickly.

- Consult with mortgage brokers or financial advisors who can provide expert guidance on market trends and help you navigate the complexities of mortgage rates.

How Monitoring Rates Can Help in Financial Decisions

- Being well-informed about mortgage loan rates gives you the knowledge to negotiate better terms with lenders and secure more favorable loan conditions.

- By tracking rates, you can calculate potential savings from refinancing or adjust your home buying timeline to take advantage of lower rates, ultimately saving you money in the long term.

- Monitoring rates empowers you to make informed decisions about your financial future, ensuring you choose the most cost-effective mortgage options available to you.

Strategies to Secure the Best Mortgage Loan Rates Today

When it comes to securing the best mortgage loan rates today, there are several strategies you can implement to improve your chances of getting favorable rates. Understanding the factors that influence mortgage loan rates and being proactive in your approach can make a significant difference in the rates you are offered.

Credit Score and Mortgage Loan Rates

Your credit score plays a crucial role in determining the mortgage loan rates you qualify for. Lenders use your credit score to assess your creditworthiness and determine the level of risk they are taking by lending to you. A higher credit score typically translates to lower interest rates, as it indicates to lenders that you are a responsible borrower.

- Monitor your credit score regularly and take steps to improve it if necessary. Paying bills on time, keeping credit card balances low, and avoiding opening new lines of credit can all help boost your credit score.

- Before applying for a mortgage loan, check your credit report for any errors that could be negatively impacting your score. Disputing and correcting these errors can potentially improve your credit score and help you secure better rates.

- If your credit score is less than ideal, consider working with a credit counselor to develop a plan for improving your creditworthiness. Taking proactive steps to boost your credit score before applying for a mortgage can lead to more competitive rates.

Negotiating Mortgage Loan Rates with Lenders

When shopping for a mortgage loan, don’t be afraid to negotiate with lenders to secure the best possible rates. Lenders may be willing to offer lower rates or better terms if you demonstrate that you are a qualified borrower and are willing to shop around for the best deal.

- Compare offers from multiple lenders to get a sense of the rates and terms available to you. Use this information as leverage when negotiating with lenders to ensure you are getting the best possible deal.

- Be prepared to ask questions and advocate for yourself during the negotiation process. Understand the terms of the loan, including any fees or penalties, and don’t be afraid to push back on anything that seems unreasonable.

- Consider working with a mortgage broker who can help you navigate the negotiation process and advocate on your behalf. Brokers have relationships with multiple lenders and can often secure better rates than you would be able to on your own.