As hedge funds for beginners takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Hedge funds offer a unique opportunity for investors to diversify their portfolios and potentially achieve higher returns. Understanding the basics and navigating the complex world of hedge funds is crucial for anyone looking to explore this investment avenue.

Understanding Hedge Funds

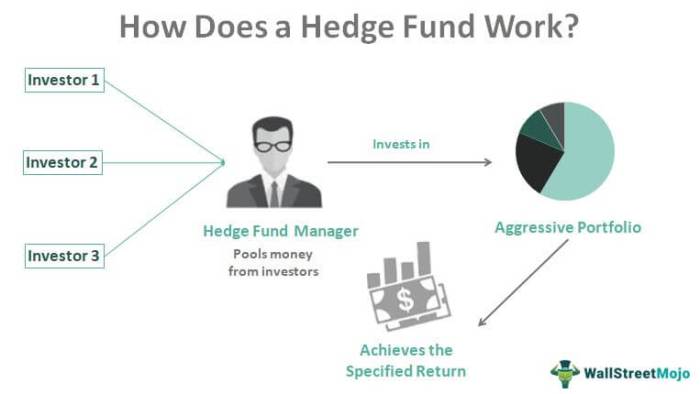

Hedge funds are investment funds that pool money from accredited investors or institutional investors and use various strategies to generate high returns. Unlike traditional investment funds, hedge funds have more flexibility in terms of investment strategies and can invest in a wide range of assets.

Basic Structure of Hedge Funds

Hedge funds are typically structured as limited partnerships, with a general partner managing the fund and limited partners providing the capital. The general partner is responsible for making investment decisions and executing the fund’s strategy, while the limited partners contribute capital.

- Hedge funds often charge both a management fee (usually around 2% of assets under management) and a performance fee (around 20% of profits).

- Investors in hedge funds are usually required to meet certain net worth or income requirements to qualify as accredited investors.

Investment Strategies of Hedge Funds

Hedge funds employ a variety of investment strategies to achieve high returns, including:

- Long/short equity: Investing in both long (buy) and short (sell) positions in stocks to profit from market fluctuations.

- Arbitrage: Exploiting price differentials in various markets to generate profits.

- Global macro: Making bets on macroeconomic trends and events around the world.

Benefits and Risks of Investing in Hedge Funds

Investing in hedge funds can offer potential benefits such as:

- Potential for high returns compared to traditional investment funds.

- Diversification of investment portfolio due to unique strategies employed by hedge funds.

However, there are also risks associated with investing in hedge funds, including:

- High fees that can eat into profits, especially if the fund underperforms.

- Lack of transparency in investment strategies and holdings.

Getting Started with Hedge Funds

When it comes to diving into the world of hedge funds, there are a few crucial steps that beginners should take to ensure they are making informed decisions and setting themselves up for success.

Before investing in hedge funds, beginners should:

- Educate themselves on the basics of hedge funds and how they operate.

- Assess their risk tolerance and financial goals to determine if hedge funds are the right investment choice.

- Consult with a financial advisor to get personalized advice and guidance.

Researching and Selecting a Suitable Hedge Fund

When researching and selecting a suitable hedge fund, beginners should:

- Look into the fund manager’s track record and experience in the industry.

- Consider the fund’s investment strategy and whether it aligns with their own financial goals.

- Review the fund’s performance history and compare it to industry benchmarks.

Investing in Hedge Funds and Requirements

The process of investing in hedge funds involves:

- Meeting the minimum investment requirements set by the fund.

- Completing the necessary paperwork and documentation to become an investor.

- Understanding the fee structure of the hedge fund, including management fees and performance fees.

Importance of Diversification

Diversification is key when investing in hedge funds because:

- It helps spread risk across different assets and reduces the impact of market fluctuations on the overall portfolio.

- By investing in a variety of hedge funds with different strategies, investors can enhance their chances of achieving consistent returns.

Hedge Fund Performance Evaluation

When it comes to evaluating the performance of hedge funds, there are several key metrics and factors to consider. Understanding how to interpret performance data and analyze historical returns is crucial for investors looking to make informed decisions. Let’s dive into the details.

Key Metrics for Evaluating Hedge Fund Performance

- Sharpe Ratio: This metric measures the risk-adjusted return of a hedge fund. A higher Sharpe Ratio indicates better risk-adjusted performance.

- Alpha: Alpha represents the excess return of a hedge fund compared to its benchmark. Positive alpha indicates outperformance.

- Beta: Beta measures the volatility of a hedge fund relative to the market. A beta of 1 indicates the fund moves in line with the market.

- Drawdown: Drawdown shows the peak-to-trough decline in the value of a hedge fund. Lower drawdowns are generally preferred by investors.

Interpreting Performance Data and Analyzing Historical Returns

- Look at the consistency of returns over time to assess the fund’s performance stability.

- Analyze the fund’s performance in different market conditions to understand its ability to generate returns in various scenarios.

- Consider the fund’s volatility and drawdowns to evaluate risk management strategies.

Benchmarking Hedge Fund Performance

- Comparing a hedge fund’s performance to a relevant benchmark helps investors assess its relative performance.

- Common benchmarks include market indices like the S&P 500 or specific hedge fund indices.

- Benchmarking can provide insights into whether a hedge fund is adding value beyond what could be achieved through passive investing.

Factors Impacting Hedge Fund Performance

- Market Conditions: Economic factors, geopolitical events, and market trends can influence hedge fund performance.

- Manager Skill: The expertise and strategy of the fund manager play a significant role in determining performance.

- Fees: High management and performance fees can eat into returns, affecting overall performance.

- Asset Allocation: The allocation of assets across different investment classes can impact returns and risk.

Risks and Challenges of Hedge Fund Investing

Investing in hedge funds comes with its own set of risks and challenges that investors need to be aware of. These risks can impact the performance of the fund and the potential returns for investors. It is important to understand these risks in order to make informed investment decisions in the hedge fund market.

Common Risks Associated with Investing in Hedge Funds

When investing in hedge funds, investors may face various risks such as:

- Market risk

- Leverage risk

- Counterparty risk

- Operational risk

- Regulatory risk

Market Volatility and Its Impact on Hedge Fund Investments

Market volatility can significantly affect hedge fund investments as it can lead to rapid price fluctuations and increased risk exposure. Hedge funds may struggle to navigate volatile market conditions, impacting their performance and overall returns for investors.

Liquidity Issues and Redemption Restrictions in Hedge Funds

Hedge funds often have liquidity issues and redemption restrictions, which can limit investors’ ability to withdraw their funds quickly. This lack of liquidity can pose challenges, especially during times of market stress when investors may want to exit their positions swiftly.

Strategies to Mitigate Risks when Investing in Hedge Funds

Investors can employ various strategies to mitigate risks when investing in hedge funds, such as:

- Diversifying their hedge fund investments

- Conducting thorough due diligence on fund managers

- Setting clear investment objectives and risk tolerance levels

- Regularly monitoring the performance of the hedge fund

- Implementing risk management techniques to protect their investments