Get ready to dive into the world of ethical investing, where aligning your investments with your values can make a real impact. This ain’t your typical investment talk – we’re breaking it down in a way that’s fresh, real, and totally rad.

Let’s jump into the nitty-gritty details of what ethical investing is all about and why it’s becoming a popular choice for savvy investors who want to make a difference.

Definition of Ethical Investing

Ethical investing, also known as socially responsible investing (SRI), is an investment approach that seeks to generate financial returns while also considering the ethical, social, and environmental impact of the companies or funds being invested in. The core principles of ethical investing involve aligning investments with personal values and beliefs, promoting sustainability, social justice, and corporate responsibility.

Importance of Aligning Investments with Personal Values

Investing in companies that align with personal values allows individuals to support businesses that are ethical and responsible in their practices. This not only helps in creating a positive impact on society and the environment but also provides a sense of fulfillment and satisfaction to the investors.

Examples of Ethical Investment Strategies

- Impact Investing: Investing in companies, organizations, or funds with the intention of generating positive social or environmental impact alongside financial returns.

- ESG Integration: Considering environmental, social, and governance (ESG) factors in the investment decision-making process to identify companies with strong sustainability practices.

- Divestment: Avoiding investments in companies involved in controversial industries such as tobacco, weapons, or fossil fuels, to promote ethical standards and responsible business practices.

- Shareholder Advocacy: Engaging with companies as a shareholder to influence corporate policies and practices towards more ethical and sustainable outcomes.

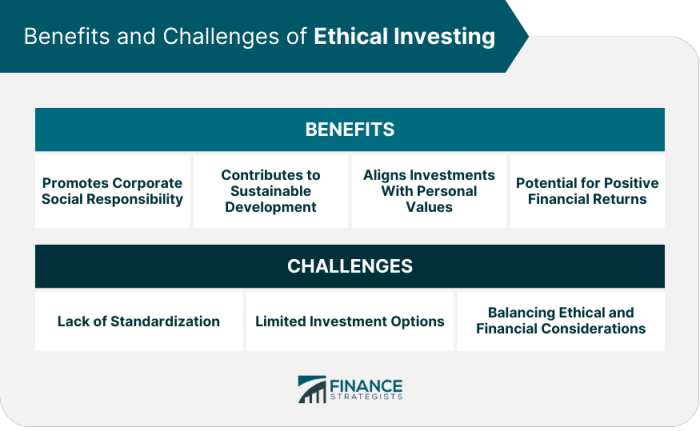

Benefits of Ethical Investing

Investing ethically goes beyond financial returns by creating positive impacts on society and the environment. Ethical investing plays a crucial role in driving positive change in corporate behavior, encouraging companies to adopt sustainable practices and social responsibility. Let’s explore the benefits in more detail:

Positive Impacts on Society and the Environment

- Ethical investing supports companies that prioritize social welfare, environmental sustainability, and ethical business practices.

- By investing in socially responsible companies, investors can contribute to initiatives that address social issues such as poverty, inequality, and climate change.

- Companies that embrace ethical practices are more likely to attract socially-conscious consumers and employees, leading to a positive impact on society as a whole.

Driving Positive Change in Corporate Behavior

- Ethical investors hold companies accountable for their actions, pushing them to operate in a more transparent and ethical manner.

- Through shareholder advocacy and engagement, ethical investors can influence corporate policies and practices towards sustainability and social responsibility.

- Companies that align with ethical standards are often more resilient to risks, including reputational damage and regulatory scrutiny, leading to long-term value creation.

Success Stories of Companies Positively Affected by Ethical Investors

- Company X increased its focus on renewable energy projects after receiving investments from ethical funds, leading to a significant reduction in carbon emissions.

- Company Y improved its labor practices and supply chain transparency following pressure from ethical investors, enhancing its reputation and attracting more customers.

- Company Z integrated diversity and inclusion initiatives into its corporate strategy with the support of ethical investors, resulting in a more inclusive workplace culture and improved employee satisfaction.

Types of Ethical Investment Vehicles

When it comes to ethical investing, there are various types of investment vehicles that investors can choose from. Each type aligns with different ethical principles and focuses on specific aspects of sustainability and social responsibility.

ESG Funds

ESG funds, which stand for Environmental, Social, and Governance, are investment funds that consider these factors in addition to financial returns. Companies included in ESG funds are evaluated based on their performance in these areas, making sure they meet certain ethical standards. For example, a company that focuses on reducing carbon emissions and promoting diversity in the workplace might be part of an ESG fund.

Impact Investing

Impact investing involves investing in companies, organizations, or funds with the intention of generating a positive social or environmental impact alongside financial returns. These investments are made in sectors like renewable energy, healthcare, or education, where the impact is measurable and tangible. An example of impact investing could be investing in a company that provides clean drinking water in developing countries.

Socially Responsible Investing

Socially responsible investing (SRI) focuses on investing in companies that align with the investor’s values and beliefs. These companies are screened based on specific social, environmental, or ethical criteria. For instance, a socially responsible investor may choose to invest in a company that promotes fair labor practices and community engagement.

Challenges and Risks of Ethical Investing

Investing ethically comes with its own set of challenges and risks that investors need to be aware of in order to make informed decisions. While the benefits are clear, navigating these challenges is crucial for successful ethical investing.

Market Volatility

Market volatility can pose a significant challenge for ethical investors. The values of companies can fluctuate rapidly based on various factors, impacting the performance of ethical investment portfolios. To mitigate this risk, diversification across different industries and regions can help spread out the risk.

Limited Investment Options

One of the challenges faced by ethical investors is the limited pool of investment options available. Ethical investing criteria may exclude certain industries or companies, leaving investors with fewer choices. To address this challenge, investors can seek out specialized ethical investment funds that align with their values.

Greenwashing

Greenwashing is a significant risk in the world of ethical investing. Some companies may falsely claim to be environmentally or socially responsible to attract ethical investors. Conducting thorough research and due diligence on companies and funds can help investors identify genuine ethical opportunities and avoid falling victim to greenwashing tactics.

Ethical Dilemmas

Ethical dilemmas can also arise in the realm of ethical investing. Investors may face situations where their ethical values conflict with potential investment opportunities. Developing a clear set of ethical guidelines and principles can help investors navigate these dilemmas and stay true to their values while making investment decisions.

Regulatory Changes

Changes in regulations and policies can impact the landscape of ethical investing. Investors need to stay informed about evolving regulations and adjust their investment strategies accordingly. Keeping up-to-date with the latest developments in ethical investing can help mitigate regulatory risks and ensure compliance with ethical standards.

Criteria for Evaluating Ethical Investments

When evaluating ethical investments, it is crucial to consider specific criteria that align with your values and financial goals. Conducting thorough research is essential to ensure that your investments support causes you believe in and adhere to your ethical standards.

Environmental Impact

- Assess how companies manage their environmental footprint.

- Consider their approach to renewable energy, waste management, and conservation efforts.

- Look for certifications or commitments to sustainability practices.

Social Responsibility

- Evaluate companies’ relationships with employees, customers, and communities.

- Examine labor practices, diversity and inclusion initiatives, and philanthropic activities.

- Review their involvement in social causes and ethical business practices.

Governance Practices

- Investigate companies’ leadership structure and transparency in decision-making.

- Check for ethical standards in executive compensation and board diversity.

- Assess their policies on bribery, corruption, and overall corporate governance.