As dividend growth investing takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Get ready to dive into the world of dividend growth investing, where the potential for long-term wealth creation awaits those who understand the nuances of this investment strategy.

Introduction to Dividend Growth Investing

Dividend growth investing is a strategy where investors focus on building a portfolio of stocks that have a history of consistently increasing their dividends over time. Instead of relying solely on capital gains, this approach emphasizes the steady income generated by dividends.

One of the key benefits of dividend growth investing is the potential for a reliable and growing stream of passive income. As companies increase their dividends year after year, investors can enjoy a rising cash flow without having to sell their shares.

Historically, dividend growth investing has outperformed other investment strategies in terms of long-term returns. Companies that have a track record of increasing dividends tend to be financially stable and well-managed, leading to strong performance even during market downturns.

Historical Performance of Dividend Growth Investing

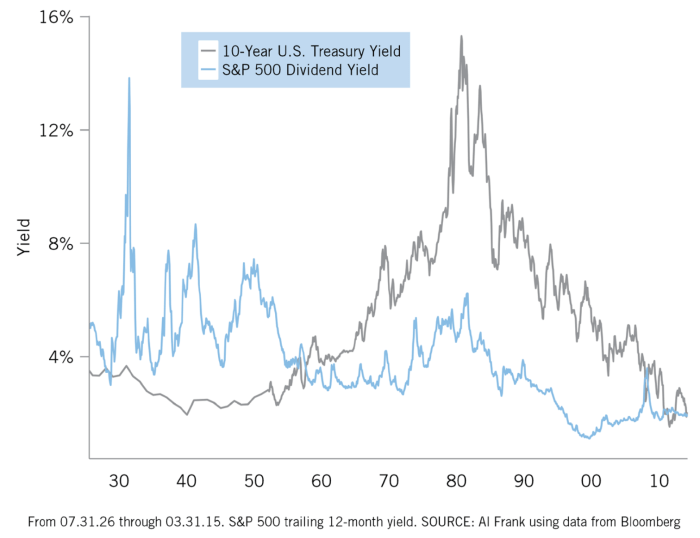

When comparing the performance of dividend growth investing to other strategies like pure growth or value investing, studies have shown that dividend growth stocks have delivered competitive returns with lower volatility. Over the long term, reinvesting dividends can significantly boost total returns, making this strategy appealing to investors looking for a combination of income and growth potential.

Key Principles of Dividend Growth Investing

Dividend growth investing focuses on investing in companies that have a track record of consistently increasing their dividend payments over time. This investment strategy is popular among long-term investors seeking to generate passive income and benefit from the power of compounding.

Characteristics of Companies Suitable for Dividend Growth Investing

- Stable and predictable earnings: Companies with stable and growing earnings are more likely to sustain and increase dividend payments.

- Strong cash flow: Adequate cash flow ensures that companies can continue paying dividends even during challenging economic conditions.

- Low debt levels: Companies with manageable debt levels are better positioned to maintain dividend payments and invest in growth opportunities.

- History of dividend growth: Look for companies with a consistent history of increasing dividends to demonstrate financial stability and commitment to shareholders.

Concept of Dividend Yield and Its Influence on Investment Decisions

Dividend yield is a financial ratio that indicates the annual dividend income as a percentage of the current stock price. Investors use dividend yield to assess the income potential of a stock and compare it to other investment opportunities. A higher dividend yield may attract income-focused investors, but it’s essential to consider the company’s sustainability and growth prospects.

Importance of Dividend Sustainability in Dividend Growth Investing

Strategies for Dividend Growth Investing

When it comes to dividend growth investing, there are various strategies that investors can employ to maximize returns and build a strong portfolio. Let’s explore some of the key strategies in detail.

High-Yield vs. Dividend Growth Stocks

- High-Yield Stocks: These stocks typically offer a higher dividend yield but may not have the same potential for long-term growth as dividend growth stocks. Investors looking for immediate income often favor high-yield stocks.

- Dividend Growth Stocks: These stocks may have a lower initial yield, but they have a history of increasing dividends consistently over time. This can lead to significant income growth and capital appreciation in the long run.

Role of Dividend Reinvestment Plans (DRIPs)

Dividend reinvestment plans (DRIPs) allow investors to automatically reinvest their dividends back into additional shares of the same company. This can help compound returns over time by purchasing more shares without incurring additional transaction costs.

DRIPs are a powerful tool for increasing the total return on investment by leveraging the power of compounding.

Successful Dividend Growth Investing Strategies

- Dividend Aristocrats: Some renowned investors follow the strategy of investing in Dividend Aristocrats, which are companies with a history of consistently increasing dividends for at least 25 years. These companies are often considered stable and reliable investments.

- Dividend Growth Investing with a Focus on Quality: Another successful strategy is to focus on high-quality companies with strong fundamentals and a track record of dividend growth. By selecting companies with sustainable business models, investors can benefit from long-term growth and income generation.

Risks and Challenges in Dividend Growth Investing

When it comes to dividend growth investing, there are certain risks and challenges that investors need to be aware of in order to make informed decisions and protect their portfolios. One of the key risks associated with this investment strategy is interest rate risk, which occurs when interest rates rise, causing the value of dividend-paying stocks to decrease. Market volatility is another risk factor, as fluctuations in the market can lead to unpredictable changes in stock prices and dividends.

Impact of Economic Cycles

- Economic cycles can have a significant impact on the performance of dividend-paying stocks. During economic downturns, companies may struggle to maintain their dividend payouts, leading to a decrease in dividend income for investors.

- Conversely, during economic upturns, companies may increase their dividends as they experience growth and profitability. However, this also comes with the risk of overpaying for stocks that may not be able to sustain their dividend growth in the long run.

- It is essential for investors to understand how economic cycles can affect dividend growth investing and adjust their strategies accordingly to navigate potential challenges.

Mitigating Risks through Diversification and Research

- Diversification is a key strategy for mitigating risks in dividend growth investing. By spreading investments across different sectors and industries, investors can reduce the impact of any one company or sector experiencing financial difficulties.

- Research is also crucial in identifying strong dividend-paying companies with a history of consistent dividend growth. By analyzing financial statements, dividend payout ratios, and company performance, investors can make more informed decisions and mitigate risks associated with dividend growth investing.

- Combining diversification with thorough research can help investors build a resilient portfolio that can weather the challenges of market volatility and economic cycles, ultimately leading to long-term success in dividend growth investing.