Diving into the world of asset allocation strategies, we’re about to embark on a journey that delves into the intricacies of balancing your investment portfolio like a pro. Get ready to learn how strategic planning can make all the difference in reaching your financial goals.

Introduction to Asset Allocation Strategies

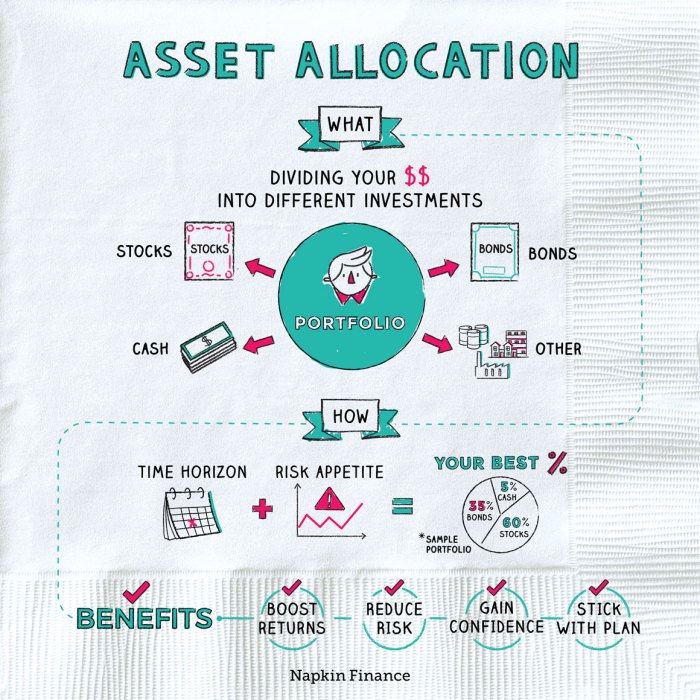

Asset allocation strategies refer to the process of dividing investments among different asset classes such as stocks, bonds, and cash equivalents to achieve specific investment goals. These strategies are crucial in creating a well-balanced investment portfolio that can help manage risk and maximize returns over time.

Goals and Benefits of Asset Allocation Strategies

Effective asset allocation strategies aim to optimize the risk-return trade-off based on an investor’s goals, risk tolerance, and time horizon. By diversifying across different asset classes, investors can reduce the overall risk of their portfolio while potentially enhancing returns. Moreover, asset allocation strategies can help investors stay disciplined during market fluctuations and avoid making emotional investment decisions.

- Diversification: By spreading investments across various asset classes, investors can reduce the impact of volatility in any single asset.

- Risk Management: Asset allocation allows investors to manage risk by balancing high-risk, high-return investments with more stable, low-risk options.

- Return Optimization: Through strategic allocation, investors can target a balance between potential returns and acceptable levels of risk.

Asset allocation is like a recipe for your investment portfolio – getting the right mix can lead to a delicious outcome!

Key Factors in Designing Asset Allocation Strategies

When designing asset allocation strategies, investors should consider factors such as their investment goals, time horizon, risk tolerance, and market conditions. These elements play a crucial role in determining the appropriate mix of asset classes that align with an investor’s objectives and preferences.

- Investment Goals: Clarifying short-term and long-term goals helps in determining the suitable allocation of assets to achieve those objectives.

- Risk Tolerance: Understanding how much risk an investor is willing to take is essential for selecting the right balance of assets in the portfolio.

- Time Horizon: The length of time an investor plans to hold investments can influence the mix of asset classes, with longer horizons typically allowing for more aggressive strategies.

Types of Asset Classes for Allocation

When it comes to asset allocation strategies, understanding the different types of asset classes is crucial. Each asset class has its own characteristics and risk profiles, which can impact the overall performance of a portfolio.

Stocks

Stocks, also known as equities, represent ownership in a company. They offer the potential for high returns but also come with high volatility and risk. Investing in a diversified portfolio of stocks can help spread out risk and capture market returns.

Bonds

Bonds are debt securities issued by governments or corporations. They are generally considered safer than stocks, offering fixed interest payments and return of principal at maturity. Bonds provide income and stability to a portfolio, especially during market downturns.

Real Estate

Real estate investments include properties such as residential homes, commercial buildings, and land. Real estate can provide rental income and potential appreciation over time. It offers diversification benefits and acts as a hedge against inflation.

Commodities

Commodities are physical goods like gold, oil, and agricultural products. They can serve as a store of value and a hedge against inflation. Commodities tend to have low correlation with traditional asset classes, making them a valuable addition to a diversified portfolio.

Diversification Benefits

Diversifying across various asset classes can help reduce overall portfolio risk by spreading out exposure to different market forces. When one asset class underperforms, others may outperform, balancing out the overall returns. This can help smooth out volatility and improve long-term performance.

Traditional vs. Modern Asset Allocation Approaches

When it comes to asset allocation strategies, there are two main approaches that investors can consider: traditional and modern methods. Each approach has its own set of advantages and disadvantages, which can impact investment decisions in different market conditions.

Traditional asset allocation methods, such as strategic asset allocation, involve creating a long-term investment plan based on a predetermined asset mix. This approach typically focuses on maintaining a fixed allocation to different asset classes, such as stocks, bonds, and cash, regardless of market fluctuations. The goal is to achieve a balanced portfolio that aligns with the investor’s risk tolerance and financial goals.

On the other hand, modern asset allocation approaches, like dynamic asset allocation and tactical asset allocation, are more flexible and responsive to changing market conditions. Dynamic asset allocation involves adjusting the asset mix based on market trends and economic indicators, while tactical asset allocation involves making short-term shifts in the portfolio to capitalize on opportunities or mitigate risks.

Advantages of traditional asset allocation methods include stability and consistency in the investment approach, which can be beneficial for long-term investors looking to minimize risk. However, this approach may limit the ability to take advantage of short-term market opportunities or adapt to changing economic conditions.

Modern asset allocation approaches offer more flexibility and responsiveness to market dynamics, allowing investors to capitalize on short-term trends or adjust their portfolios based on changing economic conditions. While this can lead to potentially higher returns, it also comes with increased risk and the potential for higher volatility in the portfolio.

Advancements in technology have played a significant role in the evolution of asset allocation strategies. Tools like robo-advisors and algorithmic trading platforms have made it easier for investors to implement modern asset allocation approaches, allowing for more precise and efficient portfolio management. Additionally, access to real-time market data and advanced analytics has enabled investors to make more informed decisions and adapt their strategies quickly in response to market changes.

Risk Management in Asset Allocation

When it comes to asset allocation strategies, managing risks plays a crucial role in ensuring the overall success of the investment portfolio. By effectively mitigating risks associated with different asset classes, investors can achieve a more balanced and stable return on their investments.

Various Risk Management Techniques

- Diversification: One of the most common risk management techniques is diversifying the portfolio across different asset classes, industries, and geographical regions. This helps reduce the impact of a single asset’s poor performance on the entire portfolio.

- Asset Correlation Analysis: Assessing the correlation between different asset classes can provide insights into how they move in relation to each other. By selecting assets with low correlation, investors can further reduce overall portfolio risk.

- Asset Allocation Rebalancing: Regularly rebalancing the asset allocation based on changing market conditions and investment goals can help maintain the desired risk-return profile of the portfolio.

Risk-Adjusted Returns

Risk-adjusted return is a measure of how much return an investment generates for the amount of risk taken. It helps investors evaluate whether the returns justify the risks associated with the investment.

- Sharpe Ratio: The Sharpe ratio is a commonly used metric to assess the risk-adjusted return of an investment. It considers both the return and the volatility of the investment to provide a more comprehensive view of its performance.

- Sortino Ratio: Unlike the Sharpe ratio, the Sortino ratio focuses on the downside risk of an investment, considering only the volatility of negative returns. This ratio is particularly useful for investors who are more concerned about minimizing losses.

Factors Influencing Asset Allocation Decisions

When it comes to making decisions about asset allocation, there are several key factors that investors need to consider. These factors play a crucial role in determining the mix of assets in a portfolio and can have a significant impact on investment outcomes.

Investor’s Risk Tolerance

- Investor’s risk tolerance refers to the amount of risk an individual is willing to take on when investing.

- Those with a higher risk tolerance may opt for a more aggressive asset allocation with a higher proportion of stocks, while those with a lower risk tolerance may prefer a more conservative approach with a larger allocation to bonds.

- It is important for investors to assess their risk tolerance periodically and adjust their asset allocation accordingly.

Investment Goals and Time Horizon

- Investment goals, such as saving for retirement or a major purchase, can influence asset allocation decisions.

- Short-term goals may warrant a more conservative approach, while long-term goals can accommodate a higher level of risk.

- The time horizon, or the length of time an investor plans to hold their investments, also plays a significant role in determining asset allocation.

Market Conditions and Economic Indicators

- Market conditions, such as interest rates, inflation, and overall economic performance, can impact asset allocation decisions.

- Investors may adjust their allocations based on the current economic environment to optimize returns and manage risks.

- Economic indicators like GDP growth, unemployment rates, and consumer confidence can provide valuable insights for asset allocation decisions.